Retail traders are loading up on stocks with poor fundamentals but high short interest

The meme-stock frenzy is back this summer, with some new names drawing traders' attention. Kohl's Corp (NYSE:KSS) stock entered the spotlight earlier this week, jumping 8.8% on Monday and a whopping 37.6% on Tuesday. Today, the retailer was last seen down 15.2% at $12.18, dropping back into negative territory for the year, though the $12 level looks like it could move in as support.

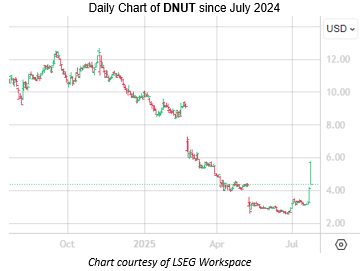

Shares of Krispy Kreme Inc (NASDAQ:DNUT) were last seen up 6.9% at $4.41, extending yesterday's 26.8% pop and heading for their fourth-straight gain. The stock jumped as high as $5.73 straight out of the gate this morning but has since pared gains, dropping back into penny stock territory. This much-needed rally has DNUT removing itself from a June 24 record low of $2.50, with the shares still down 55.6% year to date.

GoPro Inc (NASDAQ:GPRO) is up 26.3% at $1.73, hitting 52-week highs and building on yesterday's 41% pop as it heads for its sixth consecutive daily win. The stock has been in penny stock territory for a little over two years now, hitting a record low of 40 cents on April 9. Yesterday, the stock closed above its 320-day moving average for the first time since January 2022.

Of course, all three stocks are seeing high options volume today. KSS has seen 88,000 calls and 88,000 puts exchanged -- 3.6 times the average daily amount already -- with new positions opening at the most-active weekly 7/25 12-strike put. DNUT has seen 148,000 calls and 78,000 puts cross the tape -- 34.5 times the average daily options volume -- with new positions opening at the most-popular August 5 call. And 87,000 GPRO calls and 55,000 puts have exchanged hands -- 25.3 times the average daily volume -- with new positions opening at the top two contracts, the August 2 and 3 calls.

The common thread between apparel, donuts, and cameras is short squeeze potential. A la GameStop (GME) in 2020, retail traders love targeting heavily shorted stocks, hoping to squeeze out bearish bettors for outsized gains. Sure enough, KSS and DNUT have a whopping 49 and 31% of their total available float sold short, respectively, while nearly 10% of GPRO's total available float is sold short.