“As such, a risk to bulls, with the above technical levels in mind, is the Trump administration sounding ‘less friendly’ in the days and weeks ahead as they attempt to iron out trade deals and in the context of the SPX’s recovery as trade war de-escalation took root.”

-Monday Morning Outlook, May 19, 2025

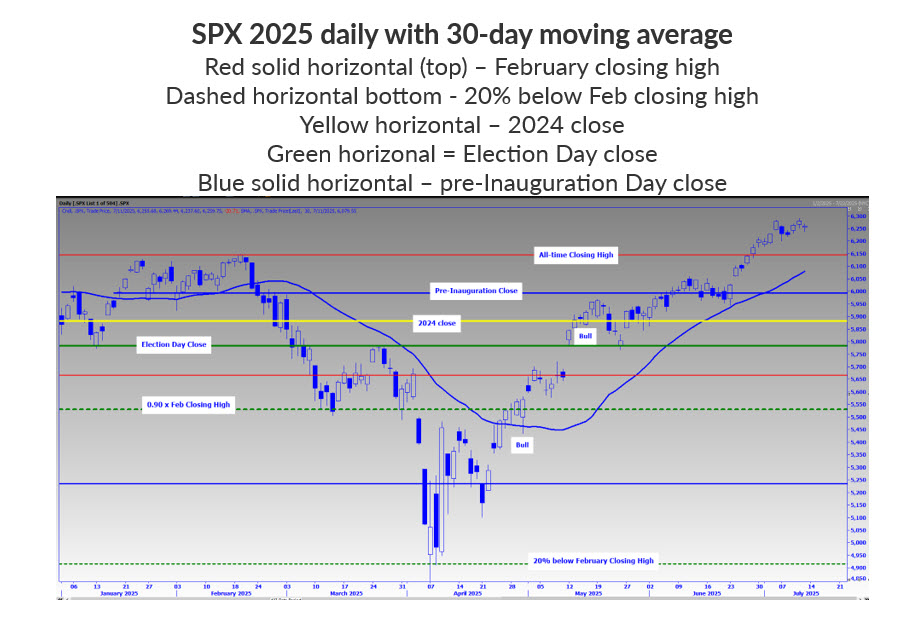

In mid-May, with the S&P 500 Index (SPX—6,259.75) trading back above its 2024 and Election Day 2024 closes, I observed a risk related to President Donald Trump’s shifting strategies with respect to tariffs. As stocks sold off sharply in February and March, driven by the Trump Administration’s announcement of huge tariffs on trade partners around the world, Trump told us not to pay attention to the stock market and instead on the direction of oil prices, which were headed lower.

But there is evidence that Trump was paying attention to stock prices, as the early April shift to kick the can down the road with respect to the “Liberation Day” tariffs occurred at the precise time the SPX was trading 20% below its February all-time closing high – a bear market according to some technicians.

If I am correct about the timing of taking a slightly softer stance on tariffs with respect to equity prices, it would only be natural that Trump might become bolder on tariff strategy amid a recovery in stock prices.

Barometers of a “recovery” at the time that could have made the Trump Administration bolder include:

- The SPX above its year-end 2024 close at 5,882.

- The SPX above the 2024 Election Day close of 5,783.

- The SPX above the pre-Inauguration Day close of 5,995.

- An all-time high in the SPX above the February closing high of 6,144.

With Trump observing that the SPX is at all-time highs on Truth Social, he is becoming bolder, threatening to double tariffs on many countries and imposing 50% levies on a key trading partner (Canada), in addition to ratcheting up pressure on Brazil and Vietnam last week.

With the new Aug. 1 deadline approaching and Trump’s rhetoric on tariffs becoming more threatening, the excerpt below from Friday's Bloomberg Markets Daily was interesting, in the context of the remarks I made in mid-May with respect to stock prices and tariffs.

“Donald Trump has the markets on his side in the trade war right now, and he knows it. That has some market watchers worried that investors’ calm reaction to his latest pronouncements will only embolden him to keep ratcheting up the tariffs, raising the risk of overreach that ultimately sends stock and bond prices sinking. The VIX index of US equity volatility dropped this week to the lowest since February, while an equivalent measure of fluctuations in the Treasury market fell to the lowest since 2022.”

-Bloomberg Markets Daily, July 11, 2025

Based on my mid-May comments, it is hard to disagree on risks associated with the Trump administration raising tariffs significantly, and that if such actions come, it will occur when stocks are performing well, not plummeting as they were in February and March.

No one knows what this administration will do. Amid the tariff uncertainty, the best course of action is to key in on price action and separate threats from actions. In other words, it's a risk that Trump will follow through with threats, but judging by price action, the market is viewing these threats as simply that, for now.

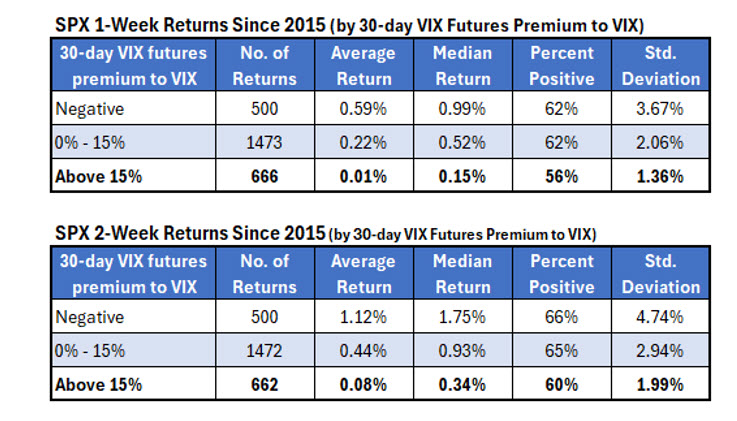

The VIX is sitting at multi-month lows amid the increasing tariff threats and looming Aug. 1 deadline. However, when looking at one-month and two-month VIX futures prices and weighting each to create a 30-day continuous VIX futures interpolated contract, the 30-day futures contract is trading at more than a 15% premium to the VIX.

Senior Quantitative Analyst Rocky White will dive further into the implications in his Indicator of the Week column posted on our website Wednesday mornings. His “at the surface” research before slicing and dicing other angles suggests that when the 30-day VIX futures interpolated contract is trading at a premium of more than 15% (bold in the tables below), the market tends to underperform one to two weeks later, relative to when the premium is smaller or when the VIX is trading above the 30-day futures contract.

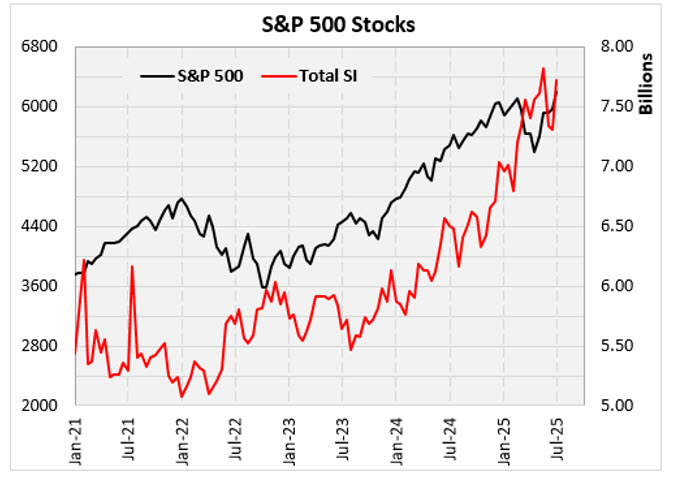

Amid SPX all-time highs and low VIX readings -- which might make hedging attractive to some of you -- a chart that crossed my desk late last week was easy on the eye for bulls who have a contrarian mindset.

Short interest data was released by the exchanges last week, and we found that total short interest on SPX components increased by 5% from the report two weeks earlier. The SPX managed gains amid the short interest build headwind, nonetheless.

Since early 2024, this continues to be a highly shorted market with total short interest on SPX components near a multi-year high. Amid the strong technical backdrop and evidence of naysayers, the naysayers are seen as a source of support on pullbacks and/or fuel for a sustained move higher, as they feel more pain.

From a short-term perspective, trader optimism is increasing in some areas of the market, evidenced by the low VIX reading relative to the 30-day interpolated VIX futures contract we created. Survey data, such as last week’s National Association of Active Investment Manager (NAAIM) survey reading of 86 out of 100, is showing increased optimism. The reading at this year’s SPX trough was 50.

If the market does pull back to wash out increasing trader optimism, I see the first level of potential support at 6,144, the former all-time closing high in February. Another potential support level is the rising 30-day moving average, currently at 6,080, but projected to be around 6,130 by the end of the week.

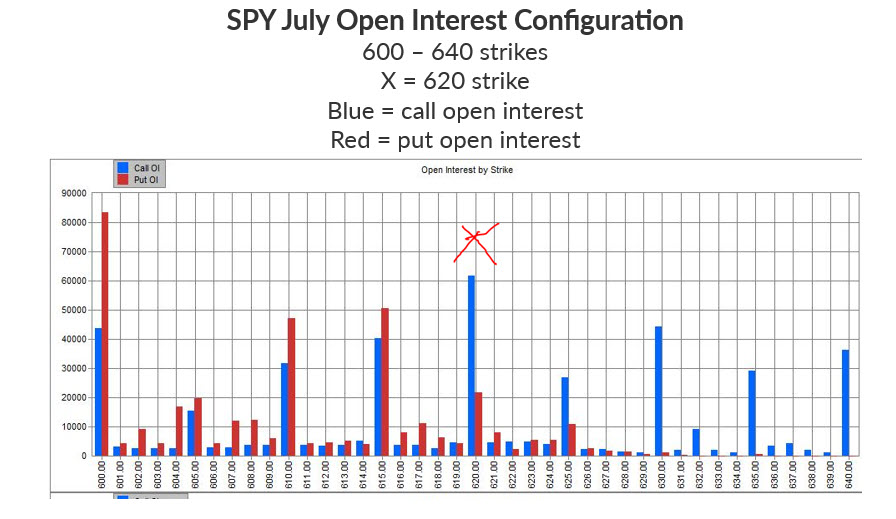

In fact, with standard July expiration week upon us, a pullback to the area between 6,130 and 6,144 on Friday would be welcomed by SPY option premium sellers, as an enormous number of SPDR S&P 500 ETF Trust (SPY—623.62) put and call options would expire worthless if the SPY is in the 613-615 vicinity at the end of the week.

Todd Salamone is Schaeffer's Senior V.P. of Research

Continue Reading: