The VIX hasn't been as low as it is now since Thanksgiving

It's VIX-Giving in April! Yes, the last time

CBOE Volatility Index (VIX) closed this low was way back on Nov. 26, 2014, the day before Thanksgiving. And that VIX reading requires a bit of an asterisk, as we had more mundane things like "turkey" and "paying five days' worth of options decay" on our minds. So before that, we need to go all the way back to Sept. 19 to see VIX this low.

The folks on the TV seem a bit perplexed as to why we're seeing VIX here now, with all the uncertainty and "blah blah blah." But, if not cheap VIX now, then when?

There's always uncertainty. We never actually get an all-clear bell. And right here, right now, we're in low-vol grind-up mode.

A good portion of earnings season is behind us -- though we still have the

Apple Inc. (NASDAQ:AAPL) kahuna.

SPDR S&P 500 ETF Trust (SPY) is near all-time highs, and 10-day realized vol in SPY is steady at about a 9. I'm not sure where VIX is "supposed" to sit now, but it sure feels about right.

And, as always, I'm not saying VIX won't lift from here. In fact, I will go on record as saying it will lift from here … probably not tomorrow, but at some point in the next month or three.

Remember all those overbought VIXes from the last half of 2014? It's a distant memory now.

The last time VIX closed 20% or more above its 10-day simple moving average was early January. We haven't had a streak of VIX non-panic this long since … this time last year. We went from January to July, a week short of six months. And then we had five distinct overbought VIX incidents in the ensuing six months, leading me to think we were perhaps morphing into a higher-VIX regime.

With the benefit of hindsight … not so much. At least, not yet. Mean VIX in 2015 sits at 15.94 now. That's up from 14.17 in 2014, but it's clearly in drift mode as we sit and stare at 2015 lows.

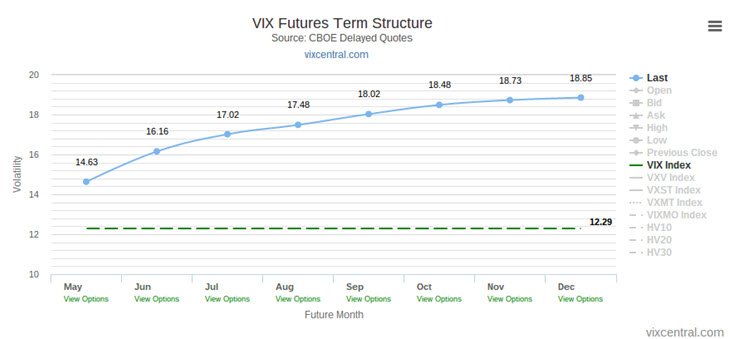

Before you go trying to "bottom" VIX, remember: You're still not buying VIX at these levels. Here's the VIX term structure (click to enlarge):

You can't even buy May VIX anywhere near the low 12s. And that only gives you a few weeks' time.

Want to play for a rerun of 2014 and a July vol spike? It sounds like a reasonable idea -- problem is, you need to pay 17 for the July VIX future.

You can, of course, just buy options with nearer-cycle expiration, and pay a lower implied vol than that. But then you're betting on a lift in realized vol more than anything else.

It might happen, of course. But you're risking that time decay will supersede your ability to flip stocks or ETFs or futures well enough to offset the decay.

The best idea to capitalize on low vol is probably just to use it to lock in some gains … or at least insure the gains. Switch stock to calls, e.g., so as to limit the downside. I like it for that, I don't like it for pure speculation on a vol lift -- just feels like there's a particular reason volatility ramps up tomorrow, and if it takes too long, it's a bad idea.

Disclaimer: Mr. Warner's opinions expressed above do not necessarily represent the views of Schaeffer's Investment Research.