Wall Street is looking past geopolitical and central bank tensions

Stock futures look ready to make a run today. Investors seem to have processed the geopolitical tensions in the Middle East, as attention now turns to the Federal Reserve. President Donald Trump is reportedly considering naming a successor to Fed Chairman Jerome Powell as early as the fall, despite Powell's term running for another 11 months. This comes amid pressure on the central bank to cut interest rates.

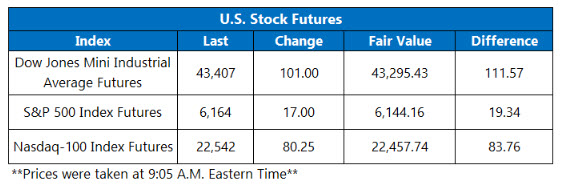

Nevertheless, futures on the Dow Jones Industrial Average (DJIA) are pointed firmly higher, while S&P 500 Index (SPX) and Nasdaq-100 (NDX) futures are indicating a shot at record highs. Elsewhere, weekly jobless claims fell to 236,000, below the 244,000 estimates.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.7 million call contracts and over 939,702 million put contracts traded on Wednesday. The single-session equity put/call ratio fell to 0.53, while the 21-day moving average stayed at 59.

- Micron Technology Inc (NASDAQ:MU) stock is 0.9% higher ahead of the bell, after the chipmaker reported fiscal third-quarter earnings and revenue that beat estimates. No fewer than 11 price-target hikes have already been doled out, the highest coming from Rosenblatt to $200 from $172. The chip stock is 51.2% higher in 2025, with most of that coming from a 46.4% quarter-to-date gain.

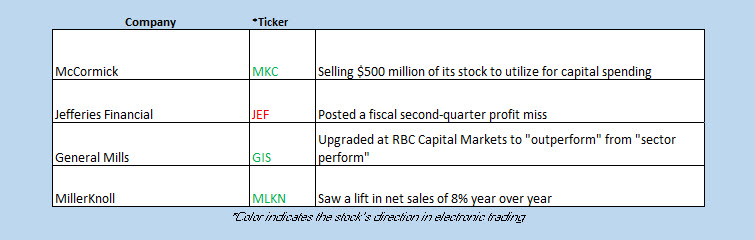

- Kratos Defense and Security Solutions Inc (NASDAQ:KTOS) stock is down 6.9% before the open, after the defense contractor announced the sale of $500 million in stock. KTOS is up 60% year to date, after hittin a June 23, 19-year high of $46.52.

- The shares of PENN Entertainment Inc (NASDAQ:PENN) are 2.5% higher in electronic trading, after the gaming company was upgraded to "market outperform" from "market perform" at Citizen. The analyst in coverage called the company a "long-term outperformer" Year to date, PENN is down 12.2%.

- Housing and consumer sentiment data on tap to end June.

Overseas Bourses Wary of Israel-Iran Ceasefire

Asian markets were mostly lower on Thursday, as investors monitored the Israel-Iran ceasefire and a lift from Citi Bank to China’s 2025 gross domestic product (GDP) forecast, now at 5%. The lone exception was Japan’s Nikkei, which added 1.7%, closing at a five-month high. Elsewhere, South Korea’s Kospi shed 0.9%, Hong Kong’s Hang Seng lost 0.6%, and China’s Shanghai’s Composite settled 0.2% lower, each brushing off a lift in the chip sector after Nvidia’s (NVDA) Wednesday record.

European markets are higher, with defense stocks among the top gainers following yesterday’s NATO defense spending update. The German DAX is up 0.5%, London’s FTSE 100 is 0.4% higher, and France’s CAC 40 was last seen up 0.2%.