Sentiment remains in favor of bulls though, but not at extremes

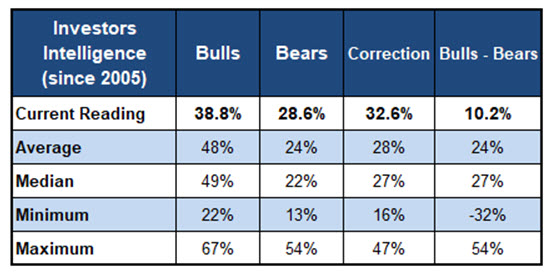

Every week, Investors Intelligence (II) puts out a poll gauging the amount of newsletter optimism and pessimism surrounding the stock market. Here are the results for the week ending Friday, June 20, and some corresponding takeaways from Senior Quantitative Analyst Rocky White.

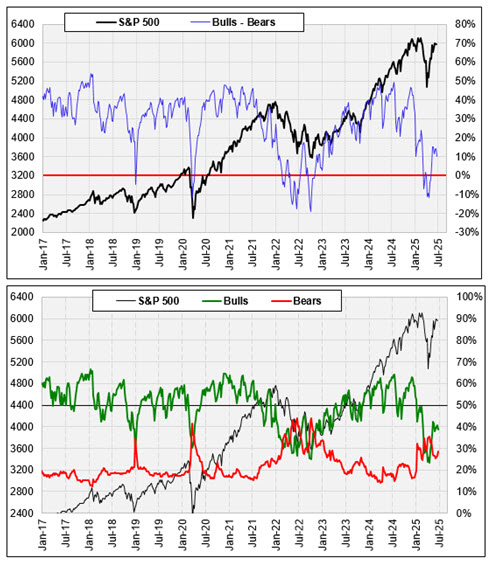

Per the top table, there was a slight decrease in optimism this week. The bulls minus bears line is around 10%. We typically consider readings below 0% or above 40% to be extreme pessimism or optimism, respectively. The table below compares the current data to typical data since 2005. The bulls are below their long-term average and the bears are near their long-term average. The bulls minus bears line is below its long-term average.