Investors kept an eye on NATO as well as Powell's commentary

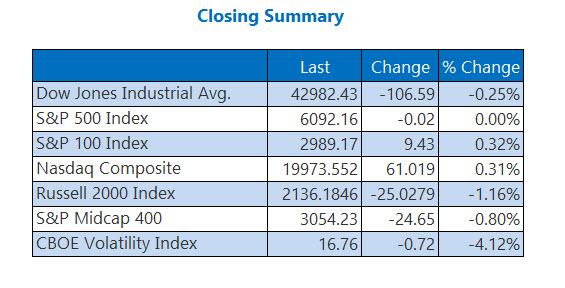

Stocks closed Wednesday mixed. The Dow snapped a three-day win streak with a triple-digit loss, the Nasdaq closed modestly higher with help from Nvidia's (NVDA) fresh record, snagging a third consecutive win, while the S&P 500 finished flat. During today's trading, both the Nasdaq and the S&P 500 came within a chip-shot of record high territory.

Fed Chair Jerome Powell reiterated the central bank's "wait-and-see" approach regarding tariffs and inflation, with no foreseeable timeline to cutting interest rates. Investors also eyed updates from the NATO summit in The Hague, and economic data showing new home sales rose at their slowest pace since October.

Continue reading for more on today's market, including:

- Duolingo stock could soon stage a rebound.

- 3 oil stocks that underperform 4th of July week.

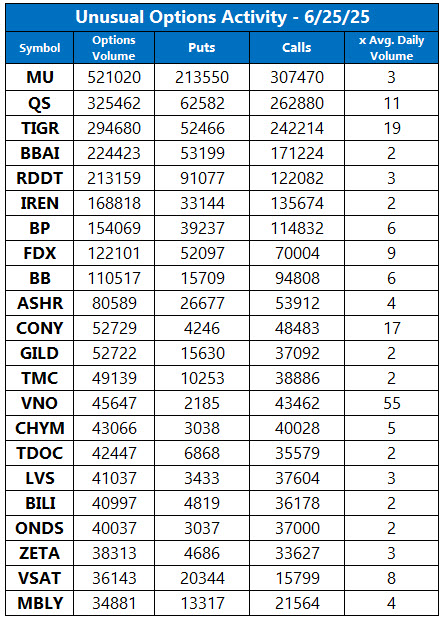

- Plus, an EV charging breakthrough; tech stock call traders are targeting; and which sector to avoid next week.

5 Things to Know Today

-

NATO will increase

defense spending to 5%, a hike that was sought after by President Trump. (

Reuters)

- Zohran Mamdani declared victory in the New York City Democratic mayoral primary. (Bloomberg)

-

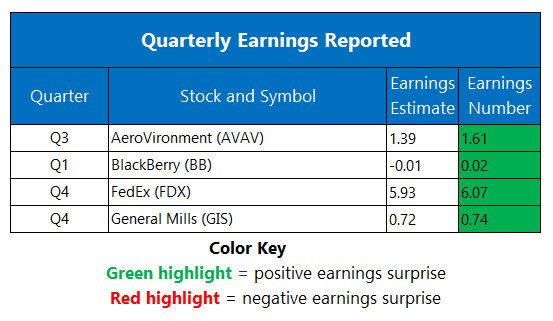

- BlackBerry shares blasted out of penny stock territory on a beat-and-raise.

- Defense stock took off flying after strong earnings.

Oil Prices Shift Higher, Ending Selloff

Oil prices rose after sharply dropping for the past two days following the Israel-Iran ceasefire. July-dated West Texas Intermediate (WTI) crude added 85 cents, or 0.85%, to close at $67.68 per barrel.

Gold prices cooled to a more than two-week low today, with investors stepping away from safe-haven assets. U.S. gold futures lost 1.8% at $3,343.10 per ounce.