Oil, on the other hand, is headed for its first win in more than two weeks

The Dow Jones Industrial Average (DJI) was up more than 200 points earlier after this morning's latest inflation update. However, the blue-chip index has since swung into the red at midday, pressured by sharp losses for Apple (AAPL) following a fresh downgrade for the FAANG stock. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) have also erased earlier gains, putting the former on track for its fifth straight loss. Elsewhere, battered oil prices are getting a reprieve today, with December-dated crude futures up 2.1% at $56.86 per barrel -- set to snap their worst losing streak on record.

Continue reading for more on today's market, including:

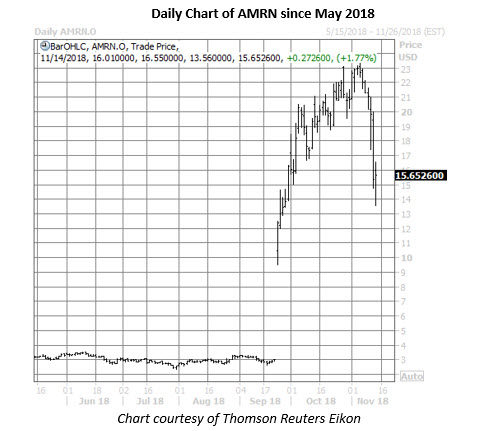

Amarin Corporation plc (NASDAQ:AMRN) is seeing unusual options volume today, with nearly 27,000 puts on the tape -- six times what's typically seen at this point. Most active are the November 15 and 16 puts, where it looks like new positions are being purchased. It's been a rough month for AMRN due to a negative reaction to the pharmaceutical firm's update on its heart disease drug, Vascepa. Today, though, Amarin stock is up 1.8% at $15.65, after Citi upgraded it to "buy," and Cantor Fitzgerald said "the peak potential sales of Vascepa is underappreciated."

Tahoe Resources Inc (NYSE:TAHO) is at the top of the New York Stock Exchange (NYSE) today, after Pan American Silver (PAAS) agreed to buy its precious metals peer for $1.07 billion in cash and stock. TAHO stock is up 44.1% at $3.17, though its year-to-date deficit remains at 33.8%.

Switch Inc (NYSE:SWCH) is at the bottom of the Big Board, after the data center operator reported disappointing third-quarter results. A price-target cut to $10.50 from $14 at BMO is only fanning the bearish flames, with SWCH stock last seen down 17.3% at $7.66, fresh off a record low of $7.49.