Square stock is coming off an impressive earnings beat

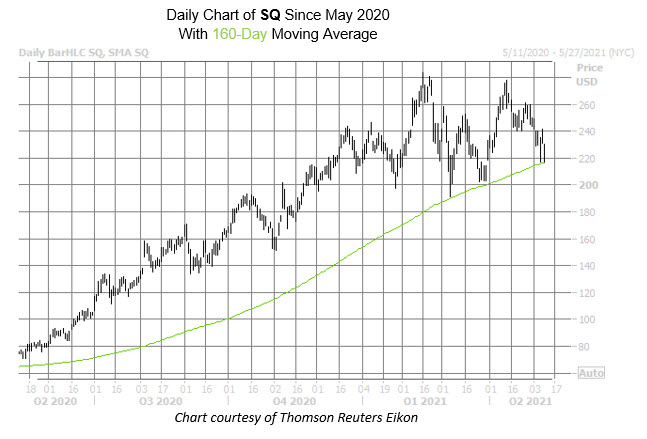

While the shares of Square Inc (NSE:SQ) are down 6.5% to trade at $218.22, taking a breather from last week's post-earnings pop, the security's dip looks to have found some footing at its 160-day moving average -- a trendline that's held as a floor for over a year. Today's drop can be attributed in part to the tech sector selloff, but analysts are keeping the faith with bull notes. This morning, BMO hiked its price target to $269 from $237 which put the 12-month consensus price target at $276.58, a 26.8% premium to current levels.

This general optimism has pervaded the options pits too. SQ once again landed on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume within the past two weeks, with names new to the list highlighted in yellow. White's table shows 382,006 calls and 196,675 puts exchanged during this time period. The most popular contract during this time frame was the weekly 4/30 260-strike call, followed by the 250- and 255-strike calls in the same series.

Today's trading remains bullishly skewed, despite the pullback. So far, 67,000 calls and 56,000 puts have exchanged hands. The two most popular positions are the May 195 put and the weekly 5/14 220-strike call, with positions being opened at both.

Analyst sentiment toward SQ also leans bullish, after several years of being unloved by the brokerage bunch. Of the 35 covering the online payments stock, 21 consider it a "buy" or better, 11 say "hold," and three consider it a "sell" or worse.

Options are an affordable way to speculate on SQ's next move. The security's Schaeffer's Volatility Index (SVI) of 48% stands higher than just 11% of readings from the part year, meaning these traders are pricing in relatively low volatility expectations at the moment. On top of this, Square's Schaeffer's Volatility Scorecard (SVS) ranks at 95 out of 100, meaning the stock has mostly exceeded these expectations during the past year -- a good thing for option buyers.