Square stock could score its fifth-consecutive win

The shares of business support concern Square Inc (NYSE:SQ) were last seen up 1.3% to trade at $265.10. The equity is on track for a fifth-straight win -- rising on the charts after dropping to $191.36 on March 5 -- its lowest level since mid-November. With long-term support from its 150-day moving average, SQ sports a healthy 342.1% year-over-year lead, and a 20.3% rise in 2021 to boot.

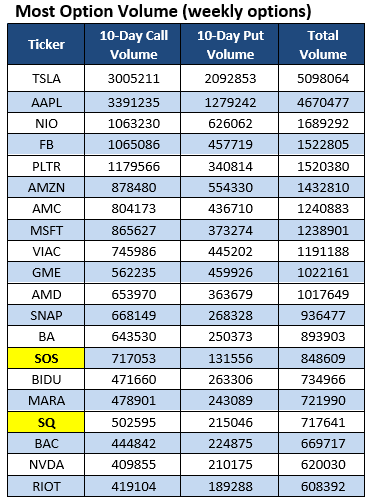

Options traders are paying close attention to Square stock. In fact, SQ has found itself on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume within the past two weeks, with new names to the list highlighted in yellow. According to this data, 502,595 calls and 215,046 puts were exchanged over this two-week period. The most popular contract during this time was the weekly 4/9 255-strike call, followed closely by the 250-strike call from the same series.

Today, SQ is seeing plenty of action from both sides of the tape. So far, 75,000 calls and 39,000 puts have exchanged hands. The April 270 call is the most popular, where new positions are being opened, followed by the 240 put from the same series. This shows plenty of speculation on the direction Square stock will take by the time these options expire at the end of the week.

Now could be a good time to weigh in on the stock's next move with options, too. SQ is seeing attractively priced premiums at the moment, per the security's Schaeffer's Volatility Index (SVI) of 53%, which sits in the relatively low 19th percentile of its annual range. What's more, the security's Schaeffer's Volatility Scorecard (SVS) sits at a high 94 out of 100. This means Square stock has exceeded volatility expectations during the past 12 months -- a boon for options buyers.