Gap and Kanye West are teaming up

While Nike (NKE) and its surprise fiscal fourth-quarter loss stirred flashing lights across Wall Street, one retail stock has had a good morning. Kanye West, acclaimed musician and burgeoning entrepreneur, announced his Yeezy brand entered a 10-year partnership with Gap Inc. (NYSE: GPS) to develop a clothing line aimed at younger shoppers. The apparel line will be available in 2021, while the controversial West -- who has previously collaborated with NKE and Adidas -- will receive loyalties and potential equity as part of the deal.

Gap stock is touching the sky today

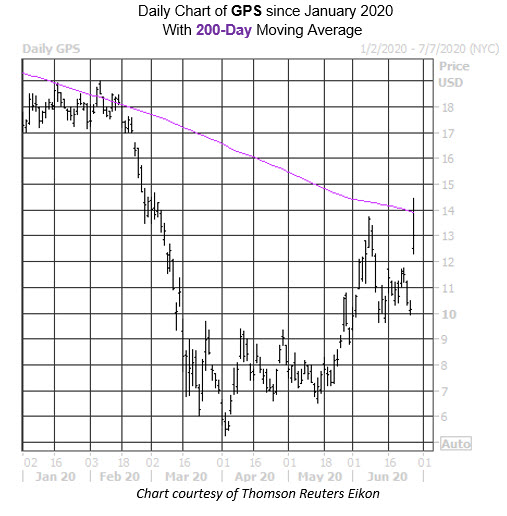

in response -- last seen up 33.4% at $13.55 -- set to run away with its best day since the pandemic. It's been far from a cruel summer for GPS; the equity has almost doubled this quarter alone, making it through the wire after its April 2 bottom of

$5.26. However, today's gains are set to fade at the shares' 200-day moving average, a trendline that hasn't been conquered on a closing basis since Feb. 14. Longer term, it will take a spaceship for Gap stock to reach its all-time 2014 heights near

$46.

This new partnership is bound to cause waves in the analyst community. Of the 17 brokerages, a clique of 16 rate GPS a "hold" or worse. Plus, the security's consensus 12-month price target of $11 is now a 9.6% discount to its current perch. A short squeeze

could also make GPS even stronger on the charts. Short interest fell by 17% in the two most recent reporting periods, yet still accounts for a healthy 16.8% of GPS' total available float.

In the options pits, calls hold all the power. In the last 10 days, 13,152 calls have been bought at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), compared to just 3,308 puts. The resultant call/put volume ratio ranks in the 100th percentile of its annual range too, underscoring a much healthier-than-usual

appetite for calls in the last two weeks. Echoing this is the security's Schaeffer's put/call open interest ratio (SOIR) of 0.80, which ranks in the bottom annual percentile -- highlighting the monster appetite for calls among short-term speculators.

Calls are the champion in the options pits today. Gap options bulls look to be digging for gold, with a whopping 192,000 calls changing hands, 15 times the average intraday amount and already a new annual high. The most popular by far is the July 15 call, with new positions being opened. Buyers of these calls are expecting GPS to fly away on the charts by July 17, when the options expire.

The glory for options traders is that premium can be had for a bargain right now. This is per the stock's Schaeffer's Volatility Index (SVI) of 93% -- in the 16th annual percentile, meaning short-term options are pricing in lower-than-usual volatility

expectations.