Senate appears to be nearing a vote on the tax and spending bill

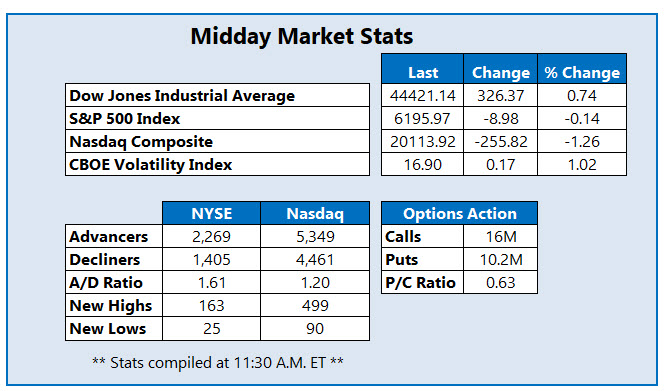

The Dow Jones Industrial Average (DJI) is the only index on track to kick off the third quarter with gains, with the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) in red to start July. Tesla (TSLA) is gapping lower after President Trump threatened to have the Department of Government Efficiency (DOGE) examine Elon Musk's government subsidies, as the two exchange barbs on social media over Trump's tax and spending bill.

Senate Majority Leader John Thune noted earlier he believes Republicans reached a deal to pass the package following days of negotiations. Also in focus, Fed Chair Jerome Powell told a panel at the European Central Bank’s (ECB) Forum that the U.S. would have cut interest rates already if tariffs hadn't come into play.

Continue reading for more on today's market, including:

- Why Hasbro stock surged to 2-year highs.

- Options bears take a bite of Sweetgreen stock.

- Plus, oil stock pulling back; Macau revenue boosts WYNN; and CEG eyes worst day since April.

Options bears are piling on Antero Resources Corp (NYSE:AR) stock, with 21,000 puts traded so far today -- 11 times the volume typically seen at this point -- compared to only 1,681 calls. Most active contract is the August 32 put, where positions are being sold to open. The shares are down 5.2% to trade at $38.18 at last check, pulling back from a June 20, nearly three-year high of $44.01 and slipping below their 40-day moving average for the first time since May. Longer term, AR still carries an 8.7% year-to-date lead.

Casino stock Wynn Resorts Ltd (NASDAQ:WYNN) is one of the best names on the New York Stock Exchange (NYSE) today, last seen up 8.5% to trade at an eight-month peak of $101.62. The outsized gains came after Macau announced a rise in gambling revenue for June. The shares are on track for their seventh gain in eight sessions, and already sport a 17.2% lead for 2025.

Toward the bottom of the NYSE today is Constellation Energy Corp (NYSE:CEG), down 5.2% to trade at $306.04 at last check. The stock is eyeing its worst day since April, after another failed attempt to conquer resistance at the $340 level, which has been locked in place since January. CEG still sports a 49.6% year-over-year gain, however.