Stocks had a stellar first half of the year

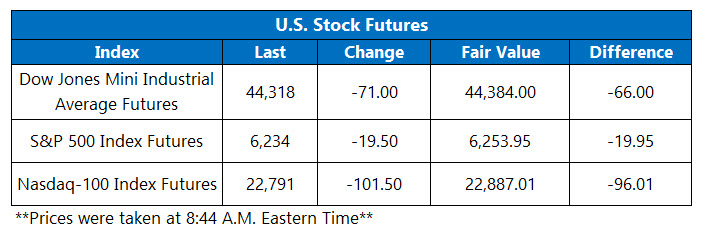

Following a exceptional day, month, and quarter, stock futures are in the red to kick off the second half of 2025. Futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are looking to pull back from record highs after the latter's best quarter in five years. Dow Jones Industrial Average (DJIA) futures are off 71 points, while investors continue to monitor the looming expiration date of President Trump's 90-day tariff pause and tensions with Canada.

Continue reading for more on today's market, including:

- Equity markets are entering a seasonally bullish period, per Schaeffer's Senior Market Strategist Matthew Timpane.

- Analyst: why we're buying Disney stock.

- Plus, AI stock brushing off upbeat quarterly results; Musk-Trump feud intensifies; and dividend boosts struggling communication giant.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.9 million call contracts and over 960,584 million put contracts traded on Monday. The single-session equity put/call ratio fell to 0.51, while the 21-day moving average stayed at 59.

- Artificial intelligence (AI) specialist Progress Software Corp (NASDAQ:PRGS) is 3.7% lower before the open, brushing off an impressive second-quarter beat-and-raise. The company also said it will purchase Spanish search startup Nuclia. Yesterday PRGS finished June with a third-straight daily win, but remains stuck below its year-to-date breakeven mark.

- Electric vehicle behemoth Tesla Inc (NASDAQ:TSLA) is once again in the news, trading down 4.8% ahead of the open, after Elon Musk pushed back Trump's threats to have DOGE look at Tesla's subsidies saying, "CUT IT ALL." TSLA is just off a fifth consecutive loss and carries a year-to-date deficit of 21.3%.

- The shares of streaming communication stock ClearOne Inc (NASDAQ:CLRO) are 122% higher in electronic trading, after the company announced a one-time stock dividend worth 100% stake for legacy shareholders. The dividend will be payable on July 18. CLRO has struggled this year, down 51% with overhead pressure stemming from the descending 20-day moving average.

- The beginning of July features the ADP employment report and manufacturing data.

Manufacturing Data out of Asia

Asian markets struggled for direction on Tuesday, as traders eyed record highs stateside and unpacked manufacturing data. The S&P 500 Global South Korea Manufacturing Purchasing Managers’ Index (PMI) rose to 48.7 in June from May’s 47.7, but remained below the 50-mark representing contraction territory for the fifth-straight month. Japan’s Manufacturing PMI rose to 50.4 in June, leaving contraction territory for the first time in 13 months. Meanwhile, the Bank of Japan’s (BoJ) quarterly Tankan survey showed business sentiment amongst large manufacturers improved in the three months leading up to June. Japan’s Nikkei fell 1.2%, falling from Monday’s 11-month high, while Hong Kong’s Hang Seng lost 0.9%. Today’s winners, the South Korean Kospi and China’s Shanghai Composite, added 0.6% and 0.4%, respectively.

European markets are lower across the board. Bond yields moved lower, while the euro rose after the euro zone inflation reading for June hit the European Central Bank’s (ECB) 2% target. London’s FTSE 100 was last seen down 0.2%, after economic data showing housing prices inched lower last month. The French CAC 40 is off 0.4%, while the German DAX is 0.6% lower.