All three major indexes are headed for outsized monthly gains

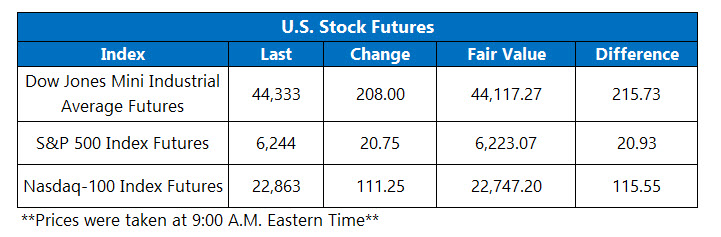

Stock futures look ready to end the month on a high note. After Friday's flourish despite trade tensions with Canada, S&P 500 Index (SPX) and Nasdaq-100 (NDX) futures look set to nab more record highs, while Dow Jones Industrial Average (DJIA) futures are also indicating a confident open.

U.S.-Canada trade developments remain in focus, after the latter rescinded its digital sales tax over the weekend. Elsewhere, President Donald Trump's "big, beautiful bill" cleared the Senate's motion to proceed to final debate on Saturday. All three major indexes indexes are eyeing healthy monthly gains to wrap up June.

Continue reading for more on today's market, including:

- How Nike stock won the day.

- Fintech stock with room to run.

- Plus, META poaching AI talent; Moderna's flu vaccine bump; and ORCL upgraded.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 2.5 million call contracts and over 1.3 million put contracts traded on Friday. The single-session equity put/call ratio stayed at 0.52, while the 21-day moving average stayed at 59.

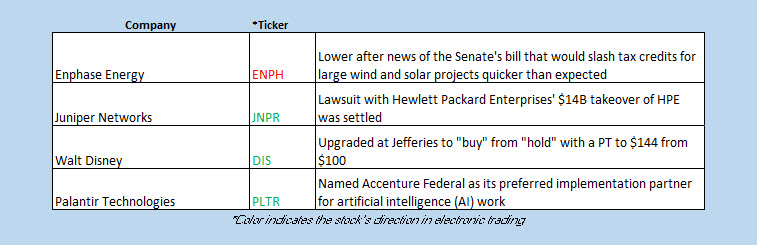

- Meta Platforms Inc (NASDAQ:META) stock is 1.7% higher before the open, after a Bloomberg report over the weekend indicated the tech titan was hiring four artificial intelligence (AI) researchers from OpenAI. META is making a run at its Feb. 14 all-time high of $740.91, and is 25.3% higher year to date.

- Moderna Inc (NASDAQ:MRNA) stock is up 3.1% ahead of the open, after the drugmaker's seasonal flu vaccine showed promising late-stage results. Moderna stock is down 34.7% in 2025, and has been consolidating between $25 and $30 since May.

- The shares of Oracle Corp (NYSE:ORCL) are 6.5% higher in electronic trading, after Stifel upgraded it to "buy" from "hold" and hiked its price target to $250 from $180. Oracle stock is poised to open at a new record high, surpassing its June 25 peak of $216.87. The shares are 50% higher year over year.

- The beginning of July features the ADP employment report and manufacturing data.

Inflation Data Moves Markets in China, Germany

Asian markets were mostly higher on Monday as investors unpacked a wave of economic data. China’s purchasing managers’ index (PMI) for June remained in contraction territory for a third-straight month, South Korea’s factory output declined a bigger-than-expected 2.9% in May, and Japan’s industrial production data for March missed analysts’ estimates with 0.5% gain. Nevertheless, Japan’s Nikkei added 0.8%, China’s Shanghai Composite tacked on 0.6%, and South Korea’s Kopi settled 0.5% higher. The only loser was Hong Kong’s Hang Seng with a 0.9% drop.

European stocks are mostly lower, despite Germany’s annual inflation rate slipping to 2% in June, meeting the European Central Bank’s (ECB) target. Investors are also monitoring tariff negotiations, as the U.S.-U.K. trade deal goes into effect. France’s CAC 40 up 0.1%, while the German DAX and London’s FTSE 100 are both down 0.2%.