All three major benchmarks marked solid weekly gains

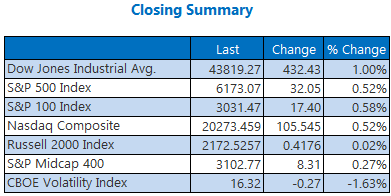

The S&P 500 and Nasdaq finished with modest session gains after earlier hitting record highs, the latter notching its fifth-straight daily win. For the week, all three major indexes finished comfortably higher, with the Dow marking its best week since early April. Meanwhile, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), closed out with its sixth consecutive daily loss.

The market received a major boost today after news the U.S.-China trade deal had been finalized. Momentum faltered a bit in the early afternoon after President Trump said he is ending all trade discussions with Canada after Ottawa's decision to impose a digital services tax on American tech companies.

Continue reading for more on today's market, including:

- A quick rundown of this week's market movement.

- Behind Trade Desk stock fresh bull note.

- Plus, more on MP's pullback; NKE's post-earnings rally; and stocks to watch next week.

5 Things to Know Today

-

A major update in President Trump's case to limit

birthright citizenship: Supreme Court curbs judges' power to block the order. (

Reuters)

- As beer sales continue to drop, BofA analysts issued greater commentary on the industry in its downgrade of Molson Coors (TAP). (MarketWatch)

-

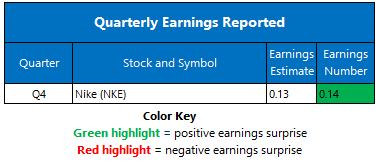

- Nike stock marks best day since 2022 after earnings.

- Incase you missed it: Best and Worst Stocks to Own Over July 4th Week.

Oil Marks Worst Week Since 2023

Oil prices suffered their worst weekly pullback since March 2023 as tensions in the Middle East continue to ease. July-dated West Texas Intermediate (WTI) crude gained 28 cents, or 0.43%, to settle at $65.52 on the day, but fell about 11% for the week.

Gold prices finished the week lower as well, as investors shift away from safe-haven assets. For the day, U.S. gold futures dropped 1.8% to $3,287.60. For the week, gold fell around 3.3%.