All three major indexes are eyeing weekly wins

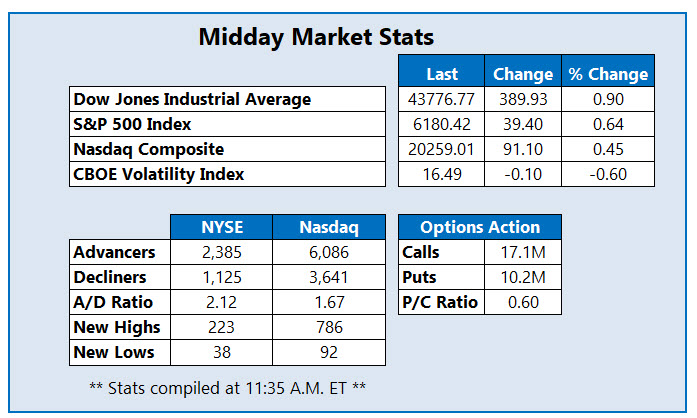

Markets are enjoying healthy gains to close out another wild week on Wall Street, with the S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC) finally snagging the record highs they've been flirting with for several days. The Dow Jones Industrial Average (DJI) is comfortably higher as well, further stabilizing above the key 20,000 mark.

Per Commerce Secretary Howard Lutnick, the U.S. trade deal with China has been finalized and around 10 other key trading partners should also see plans inked in the coming weeks. For the week, all three indexes are eyeing a 3% or higher win.

Continue reading for more on today's market, including:

- Nike stock headed for first post-earnings pop in 7 quarters.

- This rare earth giant isn't cheering the trade deal.

- Plus, call traders circle MMM; Snapchat parent surges; and NYSE newbie suffers slide.

Diversified product manufacturer 3M Co (NYSE:MMM) is 0.9% higher to trade at $152.17,continuing its climb toward its March highs. Though the catalyst remains unclear, MMM is popular in the options pits today, with 53,000 calls exchanged so far, 31 times the average daily pace. Most popular is the September 125 and 140 calls, with positions being opened at the latter. For 2025, 3M stock has added 17%.

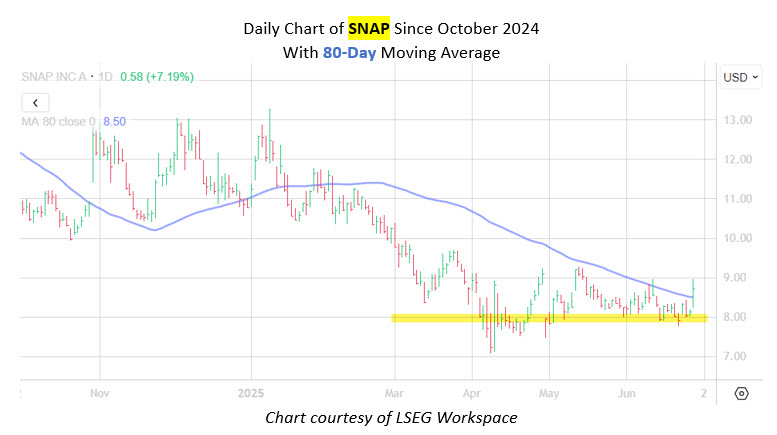

Snapchat parent SNAP Inc (NYSE:SNAP) is one of the best New York Stock Exchange (NYSE) names today, up 7.2% at $8.75 at last check, extending Thursday's gain that outpaced the S&P 500. SNAP is now eyeing its best daily performance since early May, picking away at its steep, 47% year-over-year deficit. Today's jump also has the shares looking to break above the long-term resistant, 80-day moving average, with a floor of support at $8.

One of the worst stocks on the NYSE today is stablecoin darling Circle Internet Group Inc (NYSE:CRCL), down 9.6% to trade at $193.26 at last check. The shares are pulling back after yesterday's halo lift following Coinbase Global's (COIN) bull note from Oppenheimer. The shares have shed 20% for the week, eyeing the close of their first full month publicly trading.