All three major indexes are eyeing impressive monthly wins

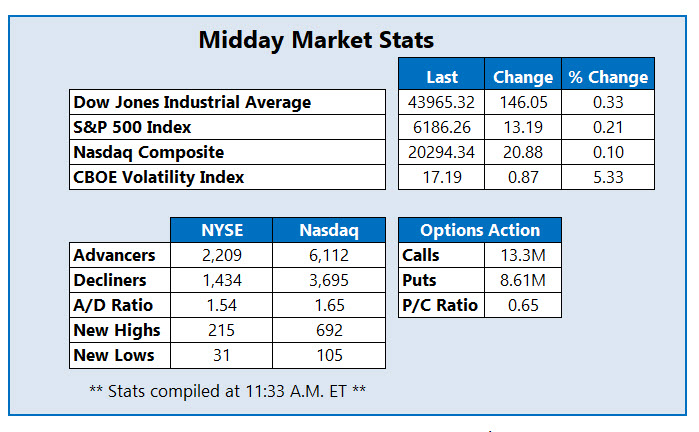

Stocks are looking to close June in the black, with the S&P 500 Index (SPX), Nasdaq Composite (IXIC), and Dow Jones Industrial Average (DJI) higher on the day, month, and quarter. The SPX and IXIC scored fresh record highs right out of the gate, with the latter headed for a sixth consecutive win. Meanwhile, the DJI is pacing for its best month since January.

Drama surrounding a trade deal between the U.S. and Canada remains in focus, with the latter rescinding its digital service tax. The GOP's "big beautiful bill" is also in focus, with the Senate now offering amendments.

Continue reading for more on today's market, including:

- DoJ settlement sends 2 tech stocks surging.

- Cloud stock surging to record highs today.

- Plus, SOFI options popular; aviation stock pops hits; and healthcare stock to avoid.

Days after revealing plans to return to its Blockchain initiatives, consumer lending stock SoFi Technologies Inc (NASDAQ:SOFI) is 8.2% higher to trade at $18.59 at last glance, after touching to a more than three-year high and eyeing its sixth-straight daily pop. SOFI is popular in the options pits, with 624,000 calls and 278,000 puts exchanged so far today, 5 times the average daily volume. Most popular is the weekly 7/11 16.50-strike call. For 2025, SOFI has has added 20.5%.

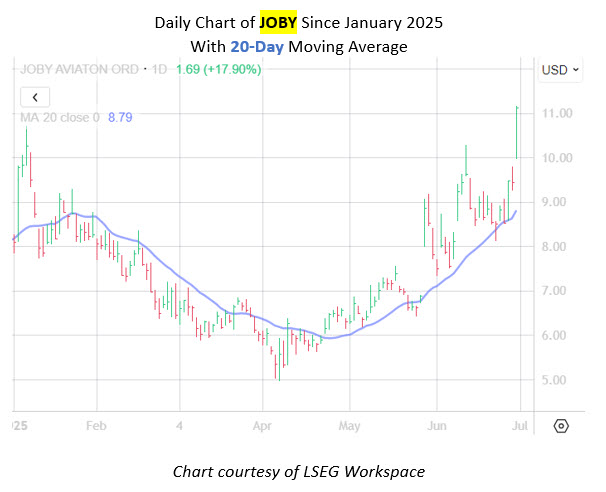

Aerospace giant Joby Aviation Inc (NYSE:JOBY) is one of the best New York Stock Exchange (NYSE) stocks today, last seen up 14.2% to trade at $10.78, surging after the company said it completed its first piloted flights in Dubai. The equity earlier surged to a nearly two-year high of $11.16 and is now 33% higher year to date. The 20-day moving average has been a steady support for JOBY this year, capturing countless pullback attempts throughout May.

One of the worst stocks on the NYSE today, Chemed Corp (NYSE:CHE) is down 14.4% to trade at $478.44 at last glance, pacing for its worst daily performance since May 2013. Shares are plummeting after the company warned second-quarter report will disappoint and cut its full-year guidance. Several analysts responded with bear notes. CHE is now well below its year-to-date breakeven level.