Stocks are struggling for direction ahead of the open

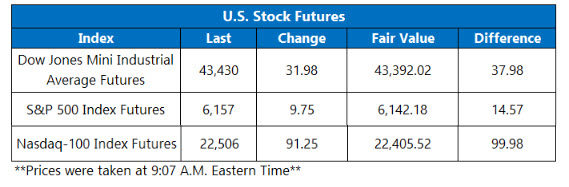

Stock futures are struggling to build on yesterday's melt-up, as investors monitor the latest geopolitical developments. Futures on the Dow Jones Industrial Average (DJIA) and S&P 500 Index (SPX) are quietly higher, while Nasdaq-100 (NDX) futures are up 91 points as the tech sector continues its resurgence. Later today, investors will be keen to hear from Fed Chair Jerome Powell for day two of his Capitol Hill testimony before the Senate Banking Committee.

Continue reading for more on today's market, including:

- Target these 25 stocks next week, per Senior Quantitative Analyst Rocky White.

- Struggling blue-chip stock to buy on the dip.

- Plus, FedEx guidance lags; YUM upgraded; and a massive bull note for COIN.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.8 million call contracts and over 1 million put contracts traded on Tuesday. The single-session equity put/call ratio stayed at 0.56, while the 21-day moving average stayed at 59.

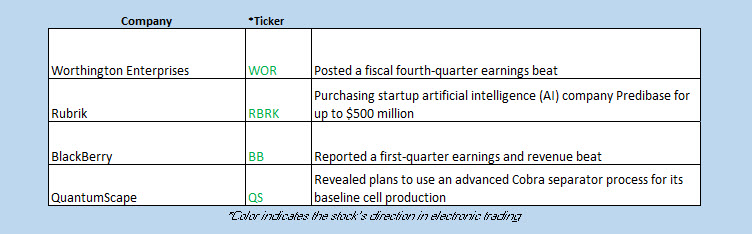

- FedEx Corp (NYSE:FDX) stock is down nearly 6% ahead of the open, after the shipping giant's weaker-than-expected current-quarter guidance overshadowed a fiscal fourth-quarter earnings beat. Four brokerages have trimmed their price targets in response, the worst coming from Citigroup to $239 from $310. FDX is down 18.4% year-to-date heading into today.

- Yum! Brands Inc (NYSE:YUM) stock is 1.7% higher before the bell, after J.P. Morgan Securities upgraded the fast food chain to "overweight" from "neutral." While the analyst did cut its price target to $162 from $170, the brokerage is bullish on the company's cash flow generation. Year-to-date, Yum stock is 6.3% higher.

- The shares of Coinbase Global Inc (NASDAQ:COIN) are 4.3% higher in electronic trading, after Bernstein issued a Street-high price-target hike to $510 from $310. The analyst in coverage cited Coinbase's dominance of the U.S. crypto market as reason for the 65% hike. COIN -- one of our top stock picks of 2025 -- is 39% higher in 2025.

- Housing and consumer sentiment data on tap to end June.

Asian Bourses Stay Hot

Ceasefire optimism and comments out of the Federal Reserve that suggested policymakers were “well positioned” sent Asian markets higher for the session. The tech sector is seeing a boost in China after regulatory licensing updates, with the region’s Shanghai Composite closing 1% higher. Elsewhere, Hong Kong’s Hang Seng added 1.3%, South Korea’s Kospi tacked on 0.2%, and Japan’s Nikkei climbed 0.4%.

Sentiment in Europe is not as upbeat, as investors monitor U.S. yield prices and keeping an eye on several notable earnings reports. At last glance, London’s FTSE 100 is flat, France’s CAC 40 is off 0.3%, and Germany’s DAX is 0.4% lower.