A resurgent tech sector powered stocks today while oil prices cooled off

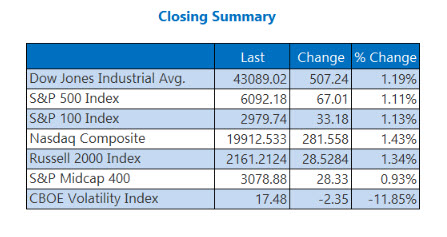

Stocks rose across the board today, as investors traded the news of an Israel-Iran ceasefire and shrugged off its fragility. The Dow added 507 points for a third-straight win and highest close since March 3, while the Nasdaq and S&P 500 each followed suit with their highest close since Feb. 20. As oil prices slipped and tech stocks surged, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), retreated back below 20, even as President Donald Trump expressed frustration with both Middle Eastern countries.

Continue reading for more on today's market, including:

5 Things to Know Today

-

- Fed Chair Jerome Powell is urging caution on interest rate cuts. (Bloomberg)

-

- McDonald's stock is also flashing an intriguing signal.

- Analyst pumps the brakes on Dollar General stock.

Crude Drops 6% as Supply Concerns Grow

Oil prices dropped sharply for the second-straight day, as supply concerns raged during the ceasefire developments. July-dated West Texas Intermediate (WTI) crude fell 6%, or $4.14, to close at $64.37 per barrel.

Gold prices cooled to a more than two-week low today, with investors stepping away from safe-haven assets. U.S. gold futures lost 1.8% at $3,333.90 per ounce.