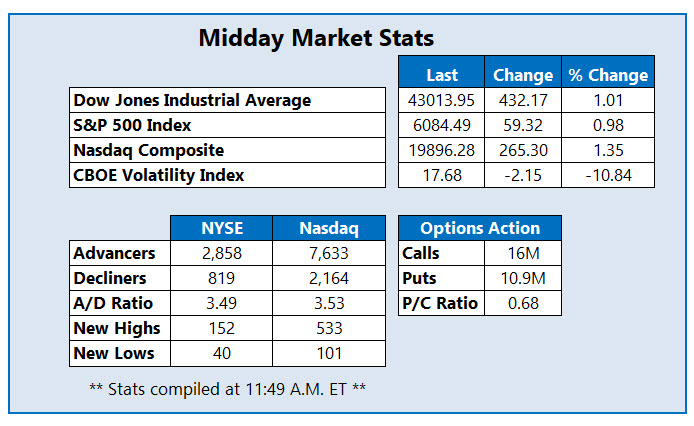

All three indexes are comfortably higher midday

The Dow Jones Industrial Average (DJI), Nasdaq Composite (IXIC), and S&P 500 Index (SPX) are all comfortably higher this afternoon, with the blue-chip index sporting a more than 400-point lead. Sentiment continued to rise on hopes that the Israel-Iran ceasefire would remain intact, despite claims both countries have already violated some guidelines. Airline stocks are also providing a lift, while crude extends its pullback.

Continue reading for more on today's market, including:

- Analyst downgrades outperforming retail stock.

- Don't miss the V-shaped rallies popping up everywhere.

- Plus, UBER popular in the options pits; cruise stock floating higher; and energy giant slammed with bear note.

Rideshare app Uber Technologies Inc (NYSE:UBER) is attracting attention in the options pits today, with 208,000 calls and 60,000 puts across the tape so far. This represents more than double the overall options volume typically seen in a day, with new positions being bought to open at the the most popular August 100 call. UBER was last seen up 7.3% to trade at $91.44, on track for its best day since April and adding to its 52% year-to-date gain.

Topping the charts on the New York Stock Exchange (NYSE) today is Carnival Cruise Line (NYSE:CCL), after the company's better-than-expected second-quarter results and hiked profit outlook. At last glance, CCL was up 9.8% to trade at $26.39, eyeing their best day since April 9 and highest mark since February.

One of the worst stocks on the NYSE today is Vital Energy Inc (NYSE:VTLE), down 5.6% to trade at $17.81 at last check. Amid oil headwinds, the energy name was downgraded to "underperform" from "outperform" at Raymond James. Now off 16% for the quarter, the shares are eyeing a fourth-straight loss, though potential support lingers below at the 50-day moving average.