Investors were caught off guard by the U.S.' attack on Iran over the weekend

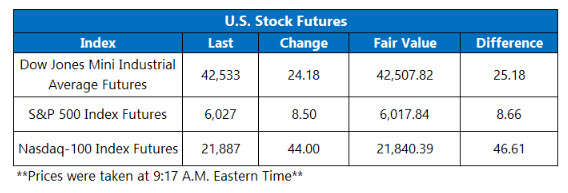

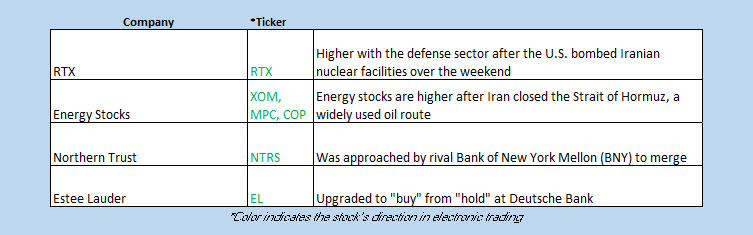

Stock futures are choppy this morning, as investors return from the weekend to more geopolitical tension. At last check, futures on the Dow Jones Industrial Average (DJIA), S&P 500 Index (SPX), and Nasdaq-100 (NDX) are modestly higher, after the U.S. struck three Iranian nuclear sites on Saturday.

The move came as a surprise, especially after President Donald Trump said on Friday he would make a decision to attack Iran “within the next two weeks." Oil prices initially swelled in response but have since cooled off, with August-dated crude last seen flat. Iran's parliament has reportedly approved closing the Strait of Hormuz, which would cripple oil flows and shipping routes.

Continue reading for more on today's market, including:

- Senior Market Strategist Matthew Timpane answers your trading questions.

- Just how resilient were stocks last week?

- Plus, NVO's obesity drug results; Fiserv adds stablecoin; DASH eyeing new highs.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 2.3 million call contracts and over 1.2 million put contracts traded on Friday. The single-session equity put/call ratio fell to 0.54, while the 21-day moving average stayed at 59.

- Novo Nordisk A/S (NYSE:NVO) stock is down 7% before the bell, after the drugmaker's obesity drug CagriSema showed no clear advantage over Eli Lilly's (LLY) Zepbound. The company also severed ties with Hims and Hers Health (HIMS) over compounding drug access. NVO is down 14.2% year-to-date.

- Fiserv Inc. (NASDAQ:FI) stock is 5.6% higher ahead of the open, after the fintech name announced a stablecoin and digital payment platform. Sector peers Circle (CRCL) and PayPal (PYPL) are also a part of the plan. FI is down 20.5% so far in 2025.

- The shares of DoorDash Inc (NASDAQ:DASH) are 2.4% higher in electronic trading, after Raymond James upgraded the food delivery concern to "strong buy" from "outperform." The analyst in coverage is bullish on the acquisition of British food service Deliveroo. DASH is 31% higher this year and poised to open at a record high.

- Housing and consumer sentiment data on tap to end June.

Overseas Markets on Edge

Asian markets were mixed today amid the escalation in the Middle East. South Korea’s Kospi shed 0.2%, while Japan’s Nikkei fell 0.1%. Meanwhile, China’s Shanghai’s Composite and Hong Kong’s Hang Seng each added 0.7%.

European markets are also lower after the attack, with defense stocks bearing the brunt of these losses. The German DAX is down 0.6%, France’s CAC 40 is 0.7% lower, and London’s FTSE 100 was last seen off 0.2%.