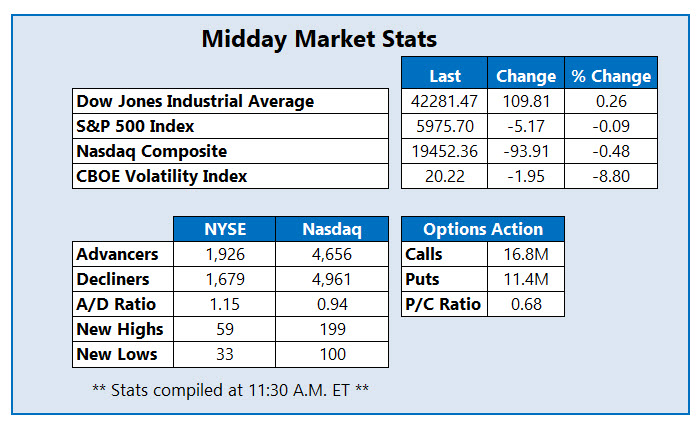

The Dow is the only index comfortably in the black

Markets are mixed this afternoon, as eyes remain on President Trump's stalling of his decision to back Israel in its war with Iran, saying a choice will be made within two weeks. Weighing heavy are chip stocks, after the Wall Street Journal suggested some waivers may be revoked by the U.S. for overseas manufacturers.

The Dow Jones Industrial Average (DJI) remains up triple digits, while the Nasdaq Composite (IXIC) and S&P 500 Index (SPX) have fully reversed course, both firmly in the red. All three benchmarks are heading for weekly wins.

Continue reading for more on today's market, including:

- Billion-dollar bidding war boosts construction stock.

- Buy, sell, wait watchlist for options traders

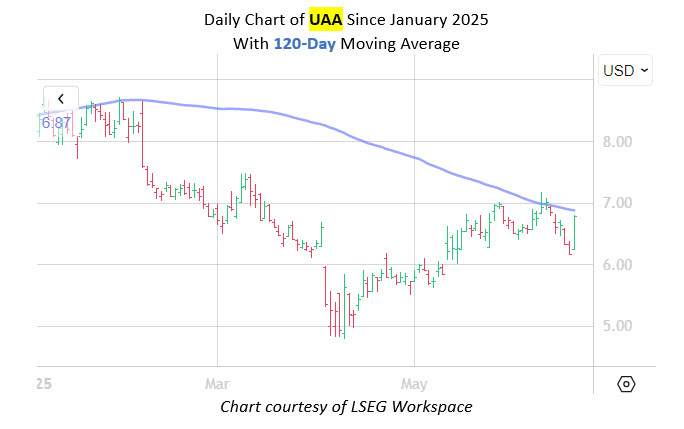

- Plus, earnings sends grocer surging; UAA faces off with resistance; and bookings blow sends ACN lower.

Grocer Kroger Co (NYSE:KR) is popular in the options pits today, with 60,000 calls and 14,000 puts across the tape so far. This represents 16 times the average intraday options volume, with positions opening at the June 72.50 and 71 calls. The equity is surging after posting a quarterly beat and raising its annual sales forecast, stating product price raises due to tariffs as a last resort. Today's jump marks the stock's best daily performance since March 2024.

Athleticwear retailer Under Armour Inc (NYSE:UAA) is one of the best performers on the New York Stock Exchange (NYSE) today, last seen up 9.8% at $6.78, eyeing its highest close in over a week. Though the catalyst for today's pop is unclear, it's well overdue, with UAA sporting a year-to-date deficit of 18% and the 120-day moving average remaining firmly overhead.

Near the bottom of the NYSE today is Accenture plc. (NYSE:ACN), down 6% to trade at $287.88 at last check. The equity is brushing off a fiscal third-quarter beat after posted a second-straight drop in quarterly bookings. ACN is off 18% in 2025, pacing for its worst day since March 20.