Tariff exemptions could extend beyond the auto sector

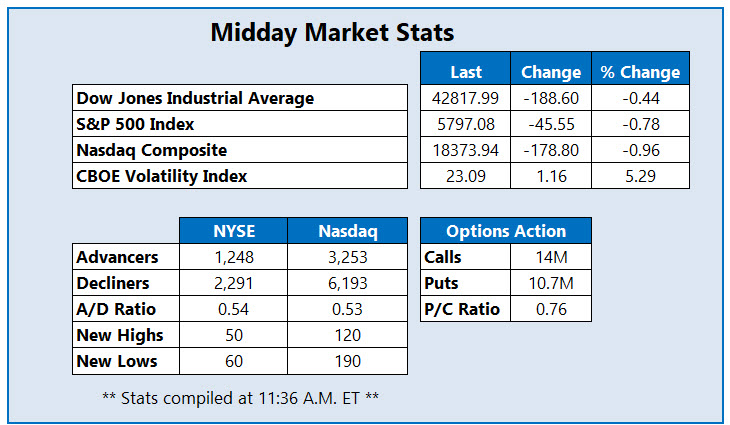

The Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are both down triple digits this afternoon, with the S&P 500 Index (SPX) trailing behind as well. This downbeat sentiment comes despite the White House suggesting one-month tariff exemptions beyond the auto sector would be likely. In addition to the latest jobs data, investors are sifting through the Federal Reserve's Beige Book as well as the Institute for Supply Management’s (ISM) manufacturing index, both which point toward fears of higher input costs due to tariffs.

Continue reading for more on today's market, including:

- Zscaler's beat-and-raise attracts bull notes.

- Weak guidance pressures MongoDB stock.

- Plus, options traders swarm CORZ; Mosaic stock extends bounce; and VSTR's pullback.

Core Scientific Inc(NASDAQ:CORZ) stock is getting blasted in the options pits today, with 109,000 calls and 57,000 puts exchanged so far, or 5 times the volume typically seen at this point. The most popular contract is the weekly 3/7 9.50-strike call, where positions are being opened. CORZ was last seen down 10.4% at $8.60, and earlier slipped to its lowest level since August after Microsoft (MSFT) withdrew some of its commitment to Coreweave. Core Scientific is planning a $1.2 billion data center expansion with the latter. Shares still sport a 118% year-over-year lead, however.

Tech stock Mosaic Co (NYSE:MOS) is leading the SPX today, last seen up 4.2% to trade at $24.92, rising alongside fertilizer peers as the sector looks likely to benefit from the tariff reprieve. The equity is extending a bounce off its March 4, four-year low of $22.49. Today's pop has MOS swinging to the positive side of its year-to-date breakeven level, but it still carries a 20.9% year-to-date deficit.

Vistra Corp (NYSE:VST) is at the bottom of the SPX, down 5.1% to trade at $120.35 at last glance, though a catalyst for today's negative price action remains unclear. Shares still boast a 97.4% year-over-year lead, while long-term support at the 200-day moving average looks poised to contain this pullback. The equity has a strong start to 2025, securing a Jan. 23, record high of $199.84 before gapping lower.