Stocks, the dollar, and gold are all volatile today

Stocks are lower midday, but have pared much steeper premarket losses, after U.S. President Trump paused tariffs on Mexico for one month. The temporary deal was struck after Mexico’s President Claudia Sheinbaum "agreed to immediately supply 10,000 Mexican Soldiers on the Border separating Mexico and the United States,” per Trump on social media platform Truth Social.

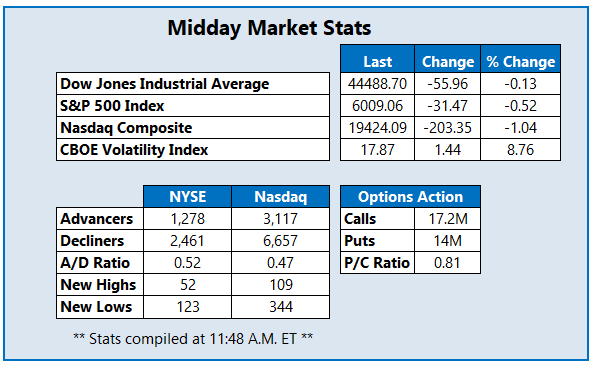

The Dow Jones Industrial Average (DJI), off by over 650 points at its session lows, was last seen only 55 points lower. The Cboe Volatility Index (VIX) raced out past 20, but has since receded below the psychologically significant level. The ICE U.S. Dollar Index was up over 1% at the onset of the selloff, but has since cooled as well.

Elsewhere, gold prices are on the rise after the Institute for Supply Management (ISM) purchasing managers index (PMI) rose to a higher-than-expected 50.9 in January, up from 49.3 in December.

Continue reading for more on today's market, including:

- Modelo brewer hit four-year lows this morning.

- Zillow Group stock upgraded on improving housing market.

- Plus, call traders target TEAM after earnings; Triumph goes private; and a healthcare stock gapping lower.

Australia-based software stock Atlassian Corp (NASDAQ:TEAM) is seeing a surge in bullish options activity today, after the company's upbeat fourth-quarter results, with help from artificial intelligence (AI) innovation. So far, 21,000 calls have been exchanged -- 11 times the call volume typically seen at this point -- in comparison to 1,925 puts. The June 250 call is the most popular, where new positions are being opened. At last check, TEAM was up 1.8% at $312.18, climbing back toward last session's two-year high of $324.37.

Aerospace and defense stock Triumph Group Inc (NYSE:TGI) is up 34.3% at $25.17 at last glance, trading at two-year highs, after the company agreed to go private in a roughly $3 billion all-cash deal with affiliates of Warburg Pincus and Berkshire Partners. Year over year, the equity is up 52.4%.

Owens & Minor Inc (NYSE:OMI) is down 23.8% at $10.85 at last look, marking four-year lows, after the company posted mixed preliminary fourth-quarter financial results ahead of its investor meeting. The healthcare name also launched financing for its Rotech acquisition. Since last February, the equity is down 45%.