The Federal Reserve kept interest rates unchanged

The major indexes saw quite a bit of volatility after the Federal Reserve kept interest rates unchanged and projected two quarter-point cuts later this year. Fed Chair Jerome Powell highlighted the uncertainty of tariffs on inflation, saying that policymakers are "well positioned to wait" before making adjustments. The armed conflict between Israel and Iran, which has now gone on for six days, remained in focus as well.

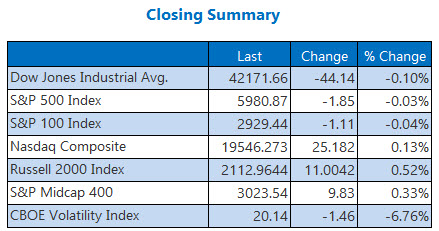

The Dow finished the day modestly lower, while the S&P 500 inched into the red by the close. The Nasdaq was the only winner, notching a quiet gain.

Continue reading for more on today's market, including:

- 3 crypto stocks rising after stablecoin bill passes through Senate.

- What the latest polling says about stock market sentiment.

- Plus, economic data coming up next week; Nucor's upbeat outlook; and the Juneteenth holiday tomorrow.

5 Things to Know Today

-

- According to UBS, 379,000 people became new millionaires in the U.S. in 2024 -- a little over 1,000 per day. (Reuters)

-

Housing and consumer sentiment data are scheduled for

next week.

- Upbeat current-quarter guidance boosted Nucor stock.

- Incase you missed it: Spotlighting Black leadership ahead of Juneteenth tomorrow.

Oil, Gold Inch Higher

Oil prices moved quietly as investors eyed updates out of the Middle East. July-dated West Texas Intermediate (WTI) crude rose 30 cents, or 0.4%, to close at $75.14 a barrel.

Bullion inched higher today after the Fed news. U.S. gold futures rose roughly 0.2% to settle at $3,412.50 per ounce.