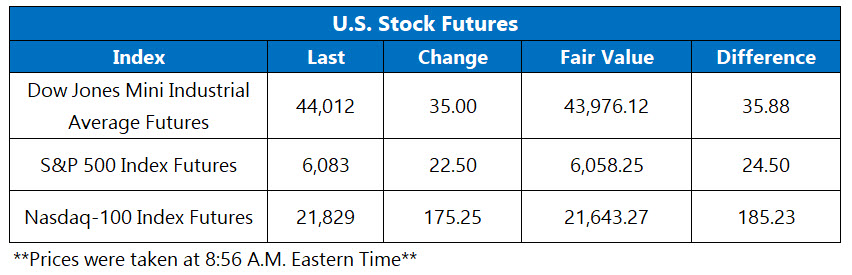

Futures on all three major benchmarks are higher this morning

Futures on the Dow Jones Industrial Average (DJIA) are attempting to brush off yesterday's hotter-than-expected inflation data, which contributed to the blue-chip index's longest daily losing streak since April. S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) futures are also higher, with the latter sporting a triple-digit lead following chipmaker Broadcom's quarterly profit win. Out of the three major benchmarks, the Nasdaq Composite (IXIC) is currently the only one pacing for a weekly win.

Continue reading for more on today's market, including:

- 3 steel stocks to monitor amid sector buzz.

- Tax strategies options traders should know about as the year winds down.

- Plus, PENN and NCLH attract upgrades; and more on Broadcom's earnings beat.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.8 million call contracts and 1.2 million put contracts exchanged on Thursday. The single-session equity put/call ratio rose to 0.68 and the 21-day moving average remained at 0.62.

-

J.P. Morgan Securities upgraded

PENN Entertainment Inc (NASDAQ:PENN) stock to "overweight" from "neutral," with the analyst in coverage noting a

path for growth for the gambling company. PENN is up 6% in premarket trading, but still carries a 23.1% year-to-date deficit.

- Broadcom Inc (NASDAQ:AVGO) stock is up 16.8% ahead of the open, after a fiscal fourth-quarter profit beat. Plus, the company said it is currently working with three big cloud customers to develop custom artificial intelligence (AI) chips. AVGO is up 61.8% in 2024.

-

Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) stock nabbed an upgrade to "overweight" from "equal weight" at Barclays. The brokerage mentioned exposure to

cross-Atlantic travel and strong U.S. demand as reasons for the bull note. NCLH is up 2.1% before the open, and added more than 33% this year.

- Retail sales data will precede Federal Reserve's interest rate decision next week.

Asian Markets React to China's Policy, Economic Data

Stocks in Asia were mostly lower today, after Beijing’s policy meeting left investors disappointed. The yen weakened for fifth consecutive day, amid wide expectations that the Bank of Japan (BoJ) will likely hold interest rates steady at its next meeting. Manufacturing in the region posted a jump to 14 for the most recent quarter, surpassing estimates and up from 13 in the September quarter. For the session, Japan’s Nikkei shed 1%, Hong Kong’s Hang Seng lost 2.1%, China’s Shanghai Composite lost 2%, and South Korea’s Kospi walked away the only gainer, adding 0.5%.

Markets across the pond are mostly flat, as gross domestic product (GDP) data out of the U.K. showed a contraction of 0.1% month-over-month, with reduced production output as the catalyst. Meanwhile, France named Francois Bayrou as the successor to Emmanuel Macron as Prime Minister. At last check, France’s CAC 40 is up 0.1%, while Germany’s DAX and London’s FTSE 100 are both flat.