Meta Platforms (META) posted a solid quarterly report

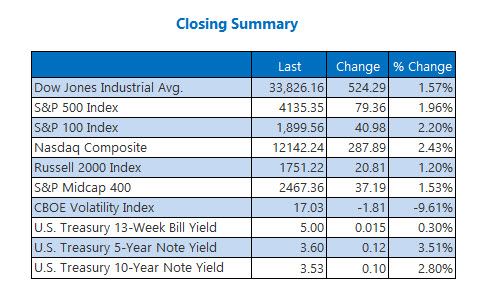

Facebook parent Meta Platforms (META) was all the rage after earnings, sending Big Tech, and subsequently the broader market, surging for Thursday's trading. Gains even came despite a disappointing gross domestic product (GDP) report, with the Dow and S&P 500 logging their best daily performances since January. Heading into Friday, the indexes are eyeing a breakeven weekly performance.

Continue reading for more on today's market, including:

- 2 airline stocks circled by options traders.

- Fed decision will highlight Wall Street next week.

- Plus, Big Tech has META to thank; partnership buzz for semiconductor; and the backbone of trading amid high volatility markets.

Things to Know Today

- The Senate Banking Committee is slated to review a bill that would give access to banking and financial services to the cannabis business community. (CNBC)

- Verizon Communications (VZ) is enjoying its best day since February 2021, after last week's steep telecom sector selloff. (MarketWatch)

- Behind the Big Tech post-earnings win for Meta stock.

- Partnership buzz sent semiconductor soaring.

- What to do when expecting high volatility.

Gold Stays Below Key Level Despite Daily Win

Black gold prices settled higher today, with June-dated crude adding 46 cents, or 0.6%, to close at $74.76 per barrel.

Gold prices posted another gain, but stayed just below the $2,000 level after today's GDP report. For the day the June-dated commodity rose $3 or 0.2%, to settle at $1,999 an ounce.