Stocks are higher despite this morning's GDP data

The Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are both up triple-digits, despite this morning's gross domestic product (GDP) data, which showed less economic growth than expected, leading the two-year Treasury yield to jump above 4%. Meta Platforms' (META) earnings results are still the highlight of the day, with the shares up 14.6% at last glance.

Continue reading for more on today's market, including:

- Delving into Meta Platforms' big earnings day.

- Semiconductor stock soars on new deal.

- Plus, options traders eye ABBV; CMPR jumps on revenue beat; and CROX drops on downbeat forecast.

Options traders are targeting AbbVie Inc (NYSE:ABBV) at nine times the intraday average volume, with 28,000 calls and 23,000 puts exchanged so far. The May 165 call is the most active, followed by the November 105 put. ABBV is down 8.6% at $147.95 at last look, after the pharmaceutical name's key drugs missed sales estimates. Today's drop has the stock slipping into the negative since the start of 2023 and year-over-year.

Cimpress PLC (NASDAQ:CMPR) is up 13.6% at $49.25 at last glance, and trading at its highest levels in roughly a year, after the company reported better-than-expected fiscal third-quarter revenue, despite wider-than-expected losses per share of $1.88. Year-to-date, the equity is up 79.4%.

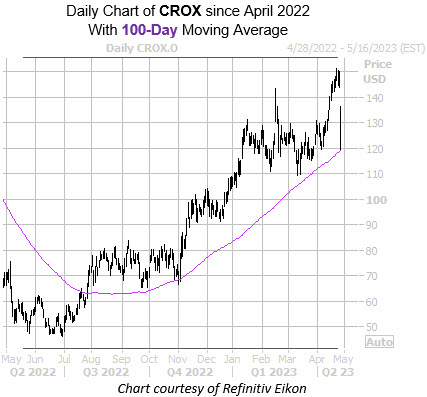

Meanwhile, Crocs Inc (NASDAQ:CROX) is down 18.7% to trade at $120.14 at last check, after the company's weak second-quarter forecast. The stock's 100-day moving average appears to be keeping losses in check, however. Year-to-date, the equity is still up 11.2%.