All three indexes secured weekly, monthly, and quarterly wins

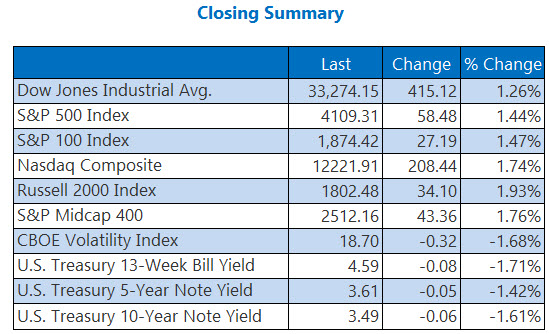

Wall Street finished both March and the first quarter 2023 with a flourish. The Nasdaq logged its best quarter since June 2020, the S&P 500 turned in its second-straight quarterly win, while the Dow rode a 415-point win to finish the quarter higher on the last day.

For the month and week, all three indexes secured solid wins. Meanwhile, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), settled lower for the sixth-straight day, while also logging weekly, monthly, and quarterly losses.

Continue reading for more on today's market, including:

- BlackBerry stock somehow won the day.

- Is the bank sector drama behind us? Wall Street thinks so.

- Plus, GNRC gaps lower; right-wing stocks break out; and all about zero-day options.

5 Things to Know Today

- The Environmental Protection Agency (EPA) will grant California the authority to require half of all heavy-truck sales to be electric by 2035. (CNBC)

- More than 157,000 technology employees have been laid off since the start of 2023. (MarketWatch)

- Why Generac stock took a breather today.

- 2 Trump-linked stocks enjoying political tailwinds.

- Should you be trading zero-day options?

Oil Prices Fall for 5th-Straight Month

Oil futures closed at their highest level in roughly three weeks today, though they fell for their fifth-straight month and snagged a quarterly loss to boot. Specifically, May-dated crude added $1.30, or 1.8%, to close at $75.67 per barrel for the session, but fell 1.8% and 5.7% for the month and quarter, respectively.

Despite earlier crossing above $2,000 an ounce earlier in the session, June-dated gold ultimately erased $11.50, or 0.6%, to settle at $1,986.20 per ounce Friday. Still, based on the most active contracts, gold rose 8.1% for the month and 8.8% for the quarter.