The Nasdaq and S&P 500 are on track for a strong quarter

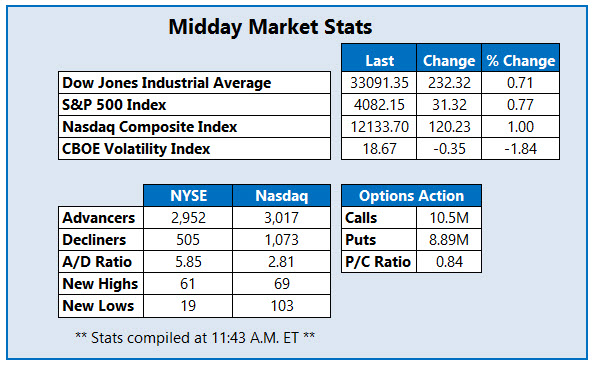

The Dow Jones Industrial Average (DJI) is boasting a triple-digit lead this afternoon, as investors unpack this morning's flood of inflation data. Unlike the S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC), the blue-chip benchmark is still eyeing a quarterly loss, though all three remain on track for weekly and monthly wins. The tech sector led much of this month's gains, with a strong performance from chip stocks. The Cboe Volatility Index (VIX) is eyeing a losing quarter, week, and month, as well as its sixth-straight daily loss.

Continue reading for more on today's market, including:

- These 2 Trump-linked stocks are moving higher.

- Analyst downgrades Generac stock on risk reward.

- Plus, options bulls blast UBS stock; quarterly win boosts YMAB; and biotech stock extends pullback.

Options bulls are blasting UBS Group AG (NYSE:UBS) today, with 52,000 calls across the tape so far today -- 27 times the intraday average volume -- compared to 1,180 puts. The April 35 and 30 calls are the most popular contacts, with positions being opened at both. UBS is up 3.2% at $21.16 at last check, amid news that Sergio Ermotti will return as CEO for the Credit Suisse (CS) takeover. The security is eyeing its first close above the 40-day moving average in over three weeks, and sports a 13.2% year-to-date lead.

Y-mAbs Therapeutics Inc (NASDAQ:YMAB) is one of the best stocks on the Nasdaq today, last seen up 69.6% to trade at $5.58. The company yesterday reported a surprise fourth-quarter profit of 3 cents per share as well as a revenue beat, with shares brushing off Canaccord Genuity's price-target cut to $18 from $20. YMAB is trading at its highest level since October, and has added 9% so far in 2023.

The shares of Annovis Bio Inc(NYSE:ANVS) were last seen at the bottom of the New York Stock Exchange (NYSE), down 20.5% at $15.99. The company today received the interim analysis for sample size re-estimation for its phase 3 clinical trial of its treatment for early Parkinson's disease. The $14.50 region looks poised to contain this pullback, as ANVS continues to cool from this week's rally to its highest level since September. Year-over-year, the equity is up 19.9%.