Bond yields are retreating today

Stocks are swinging higher today, as bond yields retreat and Wall Street bets that the worst of the regional banking crisis is in the rearview mirror. The Dow Jones Industrial Average (DJI) and Nasdaq Composite Index (IXIC) boast triple-digit leads, while the S&P 500 Index (SPX) also sits in positive territory. In other news, pending home sales rose 0.8% in February, versus economists' expectations of a 3% decline.

Continue reading for more on today's market, including:

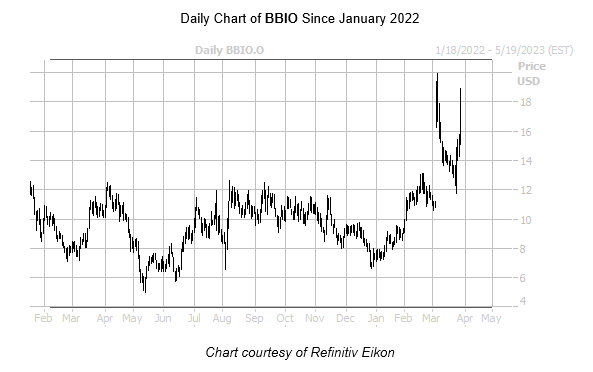

BridgeBio Pharma Inc (NASDAQ:BBIO) is tearing up the charts this year, sporting a 121.5% year-to-date lead, bolstered by today's 12.4% pop -- with the shares last seen at $16.93 and holding near their highest level since January 2022. Most recently, the equity gained on news that the company is attracting takeover interest from some larger firms. Options activity is popping for the surging stock, with total volume running at five times the intraday average amount. The April 15 call is the most popular contract, followed by the 20 call in the same monthly series, with new positions being opened at the latter.

Arcturus Therapeutics Holdings Inc (NASDAQ:ARCT) is near the top of the Nasdaq today, up 19% at $18.45 at last check. The company announced better-than-expected fourth-quarter earnings and revenue, which is helping the equity move above its year-to-date breakeven mark.

Meanwhile, bluebird bio Inc (NASDAQ:BLUE) was last seen down 30.6% at $3.00, after a dismal quarterly report. The company missed top- and bottom-line expectations, and delayed its application to the U.S. Food and Drug Administration (FDA) for its blood disorder therapy. The shares are trading at their level since June, and are down 55.4% year-to-date.