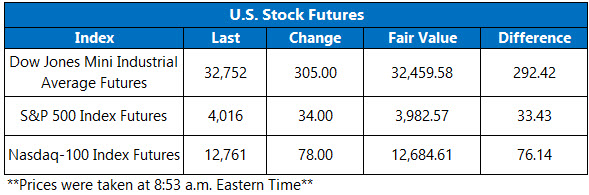

All three major benchmarks are higher ahead of the open

Futures on the Dow Jones Industrial Average (DJI) are up 305 points, as Wall Street looks to extend yesterday's bounce, while S&P 500 Index (SPX) and Nasdaq Composite Index (NDX) futures sit comfortably higher as well. Bank stocks still appear to be in recovery mode, with hopeful sentiment increasing after Treasury Secretary Janet Yellen said this morning that the government could backstop more deposits if necessary.

Continue reading for more on today's market, including:.

- Options traders targeted chip stock amid recent rally.

- New York Community Bank's new asset deal.

- Plus, 2 stocks upgraded this morning; and FRC looks to rebound.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.4 million call contracts and 696,579 put contracts traded on Monday. The single-session equity put/call ratio fell to 0.50 and the 21-day moving average stayed at 0.79.

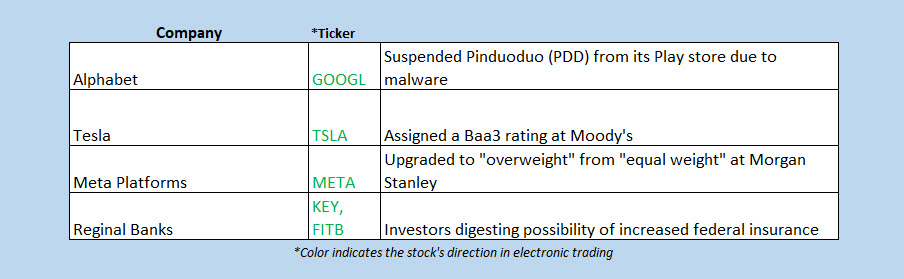

- Morgan Stanley upgraded Harley-Davidson Inc (NYSE:HOG) to "overweight" from "equal weight," citing the company's core business. Up 4.2% before the bell this morning, HOG is sporting a 9.7% year-to-date deficit heading into today.

- Foot Locker Inc (NYSE:FL) is up 4.1% premarket, after a Citigroup upped its rating to "buy" from "neutral," with a price-target hike to $50 from $47. The stock received another price-target hike as well, while two other analysts cut theirs. The retailer announced strong fourth-quarter results ahead of the open yesterday, though the shares reversed their early gains to finish the day lower. FL is 5.5% since the start of 2023.

-

First Republic Bank (NYSE:FRC) is up 23.6% in electronic trading, as the stock looks to rebound from its multi-day selloff. Since the start of the month, FRC is down 90%.

-

Bank Concerns Subside Overseas as Well

Asian markets settled mostly higher on Tuesday, as banking system fears subsided. Investors also eyed a potential interest rate hike over in the U.S. Hong Kong’s Hang Seng led the gainers with a 1.4% rise, while China’s Shanghai Composite and South Korea’s Kospi added 0.6% and 0.4%, respectively. Elsewhere, Japan’s Nikkei shed 1.4%.

European markets are also higher after the UBS takeover of Credit Suisse (CS), with the bank and financial sectors enjoying a rebound. At last check, the German DAX is up 1.8%, France’s CAC 40 is 1.7% higher, and London’s FTSE 100 sports a 1.6% gain.