The Nasdaq logged its fifth win in six sessions today

Stocks started the week off strong, with the Dow adding 382 points. The S&P 500 and Nasdaq settled firmly higher as well, the latter also scoring its fifth win in six sessions. Boosting sentiment was the UBS takeover of Credit Suisse (CS), which helped ease banking system stress. Also helping sentiment was the U.S. Federal Reserve joining forces on Sunday with central banks in Canada, England, Europe, and Japan to increase their arranged U.S. dollar swap line frequency to daily.

Continue reading for more on today's market, including:

5 Things to Know Today

- Amazon.com (AMZN) will lay off another 9,000 employees, after cutting more than 18,000 workers from November to January as it looks to streamline costs. (CNBC)

- Russian President Vladimir Putin hosted "dear friend" and Chinese President Xi Jinping for dinner after an international court called for the former's arrest days earlier. (Reuters)

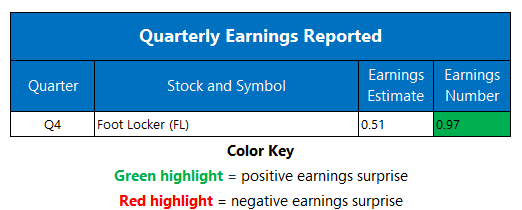

- Top- and bottom-line win pushed Foot Locker stock higher.

- New York Community Bank inks asset deal with Signature Bank.

- Another bank stock surged after this analyst's vote of confidence.

Gold Prices Near One-Year Highs

Oil prices pivoted higher on Monday, bouncing back alongside the broader market as some speculated black gold seems as oversold. April-dated crude added 90 cents, or 1.4%, to close at $67.64 per barrel on the day.

Gold prices settled higher as well, and notched a roughly 11-month high to boot. The safe haven metal is still enjoying tailwinds from the banking sector's instability. April-dated gold added $9.30, or 0.5%, to settle at $1,982.80 per ounce.