Wall Street's early year momentum is slowing down

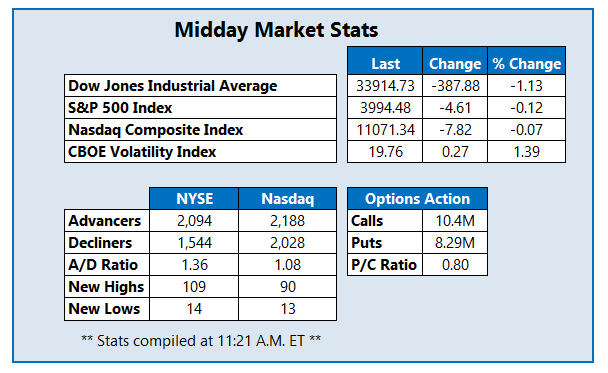

A round of earnings from the banking sector is weighing today, stifling Wall Street's early 2023 momentum. The Dow Jones Industrial Average (DJI) is down nearly 400 points at last glance, after Goldman Sachs (GS) reported its steepest earnings miss in a decade. Elsewhere, the Nasdaq Composite (IXIC) and S&P 500 Index (SPX) are hovering just below breakeven, with the former breaching the psychologically-significant 4,000 level.

Continue reading for more on today's market, including:

- 3 heavy-hitting stocks downgraded today.

- Options traders pounce on bank stocks after earnings.

- Plus, Carvana's "poison pill;" a medtech's new acquisition; and EDU's earnings.

Carvana Co (NYSE:CVNA) is up 8.4% to trade at $7.61 this afternoon, and call traders are ramping up their positions, after the online used-car retailer adopted a shareholder rights plan -- known on Wall Street as a "poison pill." This rights plan is designed to protect long-term shareholder value, though it could could be "substantially limited" in the long-term. At the session's halfway point, more than 43,000 bullish bets have been traded, which is double the average intraday volume. The equity is also on today's Short Sale Restricted (SSR) list. Amid a string of layoffs and liquidity concerns, Carvana stock has shed 95% in the last 12 months.

Santa Clara-based Shockwave Medical (SWAV) has reached a deal to buy Neovasc Inc (NASDAQ:NVCN) for nearly $75 million, helping the latter trade near the top of the Nasdaq this afternoon. Neovasc stock was last seen 28.5% higher to trade at $27.68, and earlier hit its highest level since April 2021. In the last nine months, NVCN is up more than 190%.

New Oriental Education & Tech Grp (NYSE:EDU) is trading near the bottom of the New York Stock Exchange (NYSE) after a lackluster fiscal second-quarter showing. The China-based educational service provider reported earnings that fell well below analysts' estimates, though revenue beat expectations. Year-over-year, EDU is down more than 146%.