The Dow is down triple digits before the bell

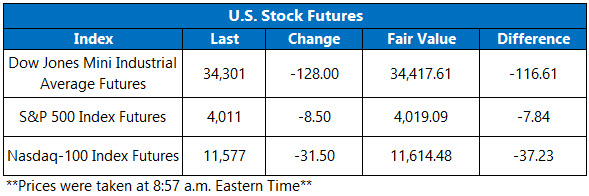

The market is eyeing a rocky start to the holiday-shortened week, following two-straight weeks of considerable gains. Dow Jones Industrial Average (DJIA) futures are down more than 100 points before the bell this morning, while futures on the Nasdaq-100 Index (NDX) and S&P 500 Index (SPX) sit modestly in the red as well. Meanwhile, the empire state manufacturing index came in at negative 32.9 in January, compared to analyst expectations of negative 7 -- its lowest level since pandemic-era 2020.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.7 million call contracts and over 1.2 million put contracts traded on Friday. The single-session equity put/call ratio fell to 0.69 and the 21-day moving average rose to 0.81.

-

Pfizer Inc (NYSE:PFE) is down 1.9% premarket, after Wells Fargo downgraded the stock to "equal weight" from "overweight," stating the shares need a reset after Covid. On the charts, the equity is fresh off its third-straight weekly loss, down 13.8% year-over-year.

- China-based tech stock Alibaba Group Holding Inc (NYSE:BABA) is in the spotlight before the bell, after news that activist investor Ryan Cohen built a stake in the company. Up 0.2% at last glance, BABA is already sporting a 32.8% year-to-date gain.

- Morgan Stanley (NYSE:MS) is up 2.1% in electronic trading, after the company posted better-than-expected fourth-quarter results. Year-over-year, the equity is down 10.6%.

- There is no more economic data of note today.

Investors Unpack China's GDP Data

Economic data weighed on Asian markets today, though Japan’s Nikkei was able to add 1.2% as the Bank of Japan’s (BoJ) two-day monetary policy meeting gets underway. In China, December retail sales fell 1.8% while fourth-quarter gross domestic product (GDP) expanded by 2.9%, both of which beat analyst estimates. However, the country’s “exit wave” during its reopening process has created problems, with GDP growing by just 3% in 2022 – its slowest annualized growth since 1976. In response, China’s Shanghai Composite lost 0.8%, and Hong Kong’s Hang Seng dipped 0.1%. South Korea’s Kospi snapped a nine-session win streak, with a 0.9% haircut.

Stocks in Europe are slightly lower, as inflation, interest rates, and economic growth take center stage at the World Economic Forum in Davos, Switzerland. At the forum, UBS CEO Ralph Hamers said 2023 will be “the year of inflection” for the global economy, while Swiss Re CEO Christian Mumenthaler said inflation won’t fall back to low levels for at least a decade. At last glance, London’s FTSE, Germany’s DAX, and France’s CAC 40 are down 0.2%, 0.1%, and 0.07%, respectively.