The Dow finished the day 482 points lower

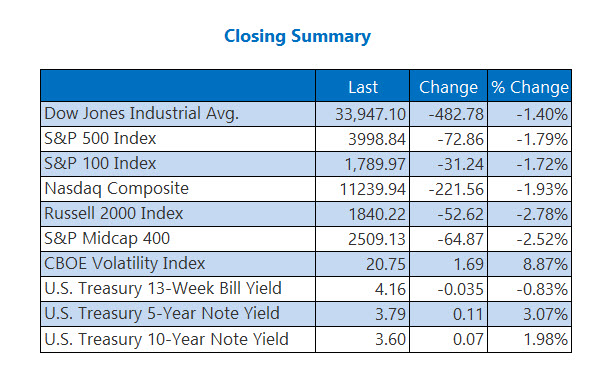

Stocks landed firmly in red ink today, with the Dow closing 482 points lower, after hotter-than-expected ISM services index data for November had Wall Street concerned over future rate hikes from the central bank. The 10-year Treasury yield surged after the news, last seen up 10 basis points. Elsewhere, the Cboe Volatility Index (VIX) snapped a four-day losing streak and logged its largest single-session gain since Sept. 23.

Continue reading for more on today's market, including:

- North Face parent falls on sudden CEO exit.

- Call traders eye GameStop stock before earnings.

- Plus, CELH flashing bull signal; TOL's impressive post-earnings history; and 3 China-based stocks to watch.

The Dow Jones Industrial Average (DJI - 33,947.10) lost 482.8 points, or 1.4% for the day. Boeing (BA) was the only Dow winner, adding 1.2%, while Salesforce.com (CRM) landed at the bottom of the list with a 7.4% loss.

The S&P 500 Index (SPX - 3,998.84) dropped 72.9 points, or 1.8% for the day, while the Nasdaq Composite Index (IXIC - 11,239.94) shed 221.6 points, or 1.9% for today's session.

Lastly, the Cboe Volatility Index (VIX - 20.63) added 1.6 point, or 8.2% for the day.

5 Things to Know Today

- The U.S. has once again delayed The Real ID Act, which was originally meant to go into effect in 2008. (CNBC)

- Over the weekend, an update came regarding the long-awaited move to open up the banking system to cannabis companies. Several cannabis stocks are getting a boost after the news. (MarketWatch)

- Further highs in sight for Celsius stock.

- Checking in with Toll Brothers ahead of its quarterly report.

- Options traders blast China-based stocks amid Covid news.

There are no notable earnings reports today.

Gold, Oil Fall for the Day

Oil prices settled lower today, the first day of trading after the European Union (EU) ban on Russian seaborne oil. West Texas Intermediate (WTI) crude for January delivery fell $3.05, or 3.8%, to settle at $76.93 a barrel -- the lowest finish for a front-month contact since Nov. 25.

Gold futures settled below $1,800 after hitting their highest level since Aug. 10 during the trading day. February-dated gold dropped $28.30, or 1.6%, to settle at $1,781.30 per ounce.