Celsius Holdings stock is flashing a historically bullish signal

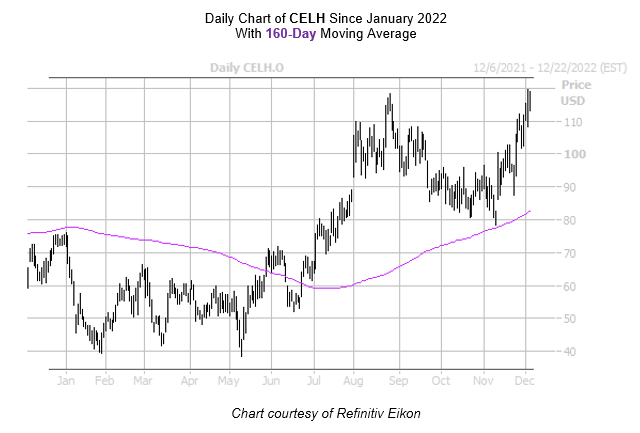

On Friday, beverage concern Celsius Holdings, Inc. (NASDAQ:CELH) hit an all-time high of $119.73. The stock bounced to this level off its 160-day moving average, a trendline that contained multi-month lows back in November. And while the shares were last seen down 1.4% at $115.96, there is plenty of reason to believe CELH will sneak past its recent high and add to its 84.2% year-over-year lead.

Celsius Holdings stock's recent peak comes amid historically low implied volatility (IV), which has been a bullish combination for the equity in the past. Per data from Schaeffer's Senior Quantitative Analyst Rocky White, eight other signals occurred in the last five years when the security was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) stood in the 20th percentile of its annual range or lower. This is currently the case with Celsius Holdings stock's SVI of 72%, which stands in the low 15th percentile of its 12-month range.

White's data shows that one month after these signals, the stock was higher 63% of the time, averaging an impressive 5.9% return for that period. From its current perch, a move of similar magnitude would place CELH at a new record high of $126.80.

A short squeeze could also keep the winds blowing for the stock. Short interest rose 10,9% in the last week, and the 8.9 million shares sold short now make up 20.3% of the security's available float.

An unwinding of options traders' pessimism could also have bullish implications. Despite Celsius Holdings stock's recent highs, short-term options traders have rarely been more put-biased. This is per CELH's Schaeffer's put/call open interest ratio (SOIR) of 0.99 that stands in the elevated 78th percentile of annual readings.