The Dow finished with a triple-digit loss

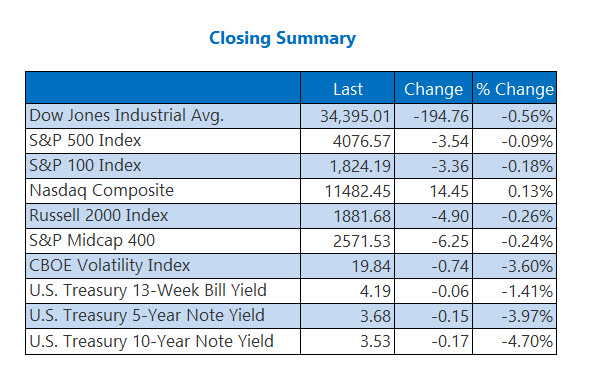

Stocks were all over the place to kick off the final month of 2022. Investors unpacked a host of economic data throughout the day, though Wall Street remains heavily fixated on tomorrow's jobs data. The Dow finished with an 194-point loss, the S&P 500 pared steeper losses but ultimately finished lower, and the Nasdaq finished with a marginal gain. Elsewhere, Costco (COST) weighed on the retail sector today after sales slowed in November, while the Cboe Volatility Index (VIX) closed below 20 for the first time since Aug. 18.

Continue reading for more on today's market, including:

- How our subscribers scored a profit with ETSY calls.

- The worst retail stock to own in December.

- Plus, Kroger options pits pop; unpacking retail earnings; and CRM's dramatic drop.

The Dow Jones Industrial Average (DJI - 34.395.01) lost 194.8 points, or 0.6% for the day. Nike (NKE) paced the gainers with a 1.3% win. Salesforce.com (CRM) dragged the blue-chip index with an 8.3% loss.

The S&P 500 Index (SPX - 4,076.57) dipped 3.5 points, or 0.09% for the day, while the Nasdaq Composite Index (IXIC - 11,482.45) rose 14.5 points, or 0.1%.

Lastly, the Cboe Volatility Index (VIX - 19.84) shed 0.7 point, or 3.6%.

5 Things to Know Today

- An update on the ongoing potential rail strike: union bosses have warned of election consequences for politicians who don't support them now. (CNBC)

- After a week of protests, which have been the largest show of public defiance in years, China plans to ease some Covid-19 restrictions. (Reuters)

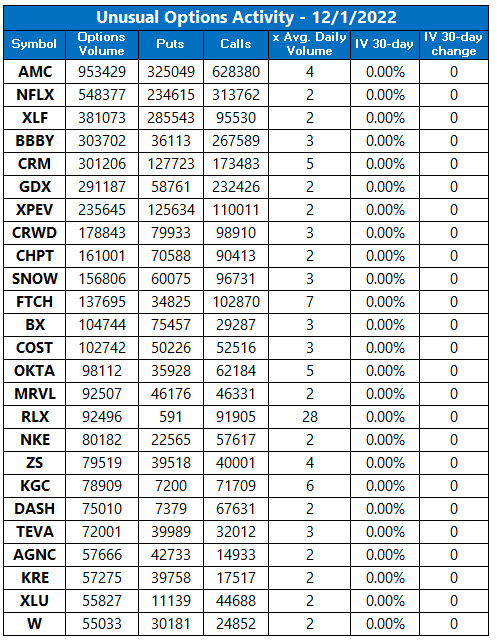

- Options traders loaded up on Kroger stock today.

- Forecast adjustments moved two discount retailers.

- Blue-chip stock spirals on C-suite shakeup.

Gold Nabs Biggest Gain in Over 2 Years

Oil prices rose for the second straight day, amid hesitantly upbeat inflation sentiment and the loosening of Covid restrictions in China. West Texas Intermediate (WTI) crude for January delivery rose 67 cents, or 0.8%, to settle at $81.22 a barrel -- the highest close for the front-month contract in two weeks.

Gold futures posted their largest one-day gain since April 2020, with February-dated gold adding $55.30, or 3.1%, to settle at $1,815.20 an ounce. This marks the first time gold has settled above the psychologically significant $1,800 level in nearly four months.