The Dow is down more than 300 points midday

It's been a busy week for economic reports, with this morning's slimmer-than-expected rise in Core Personal Consumption Expenditures Index initially boosting markets. However, with more data ahead -- namely, tomorrow's unemployment rate and non-farm payrolls -- the major indexes are sinking lower once more. The ISM Manufacturing gauge might also be dampening sentiment, after it registered a reading of 49% -- marking its lowest since May 2020. In response, the Dow Jones Industrial Average (DJI) was last seen off more than 300 points. The S&P 500 Index (SPX) is also sitting firmly in the red, while the Nasdaq Composite (IXIC) is quietly higher.

Continue reading for more on today's market, including:

- Several reasons to avoid Salesforce stock in December.

- 2 retail names boasting upbeat seasonality.

- Plus, SHOP to clear key trendline; ARCE soars on going private proposal; and licensing pressure burns GIII.

Shopify Inc (NYSE:SHOP) is seeing a bullish surge in the options pits today, with 123,000 calls exchanged so far, which is two times the intraday average, compared to 48,000 puts. The most popular is the weekly 12/2 45-strike call, followed by the 44-strike call in the same series with positions being opened at the former. SHOP was last seen up 3.8% at $42.42, and while no specific drivers are fueling this price action, the security is set for its first close above the 200-day moving average in nearly a year, and just came off a 19.4% monthly gain for November.

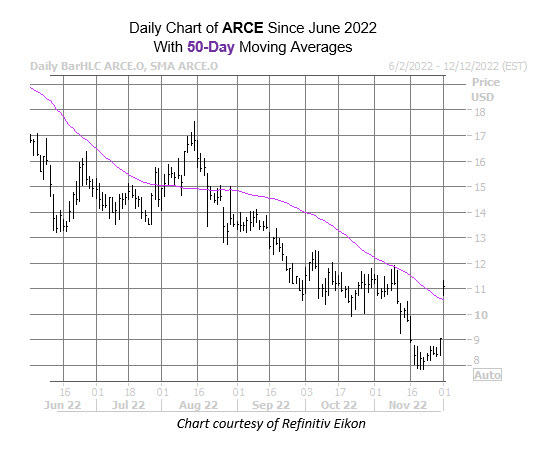

One of the best performers on the Nasdaq today is Arco Platform Ltd (NASDAQ:ARCE) after the company announced that its board received a receipt of a non-binding going private proposal from General Atlantic L.P. and Dragoneer Investment Group. The company also expected to report its third-quarter earnings after the close this evening. ARCE was last seen up 22.6% at $11.07 and is set for its first close above the 50-day moving average since mid-August.

G-III Apparel Group, Ltd. (NASDAQ:GIII) is one of the worst stocks on the Nasdaq today. The equity was last seen down 42.1% at $12.52 after the company reported mixed third-quarter earnings results and warned that licensing deals with Calvin Klein parent PVH (PVH) are set to expire from 2025 through 2027. Though GIII managed to eke out a close atop long-time pressure at its 160-day moving average during yesterday's session, it's sitting well below here today, set for its lowest settlement in over two years.