Protests against strict Covid-19 protocols in China are rattling U.S. traders

Last week's mostly upbeat sentiment was forgotten on Monday as investors anxiously eyed the pushback the Chinese government is receiving for its prolonged Covid-19 restrictions. This unrest reverberated through global markets, denting tech amid reports that demonstrations at an Apple (AAPL) factory in China could severely effect iPhone Pro production.

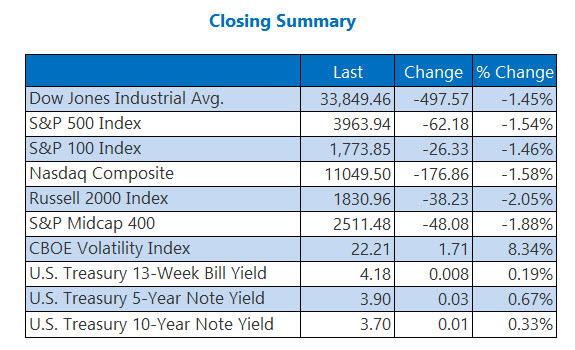

In response, the Dow shed 497 points, while the Nasdaq and S&P 500 both lost over 1%. Meanwhile, investors are looking ahead to a spate of economic data due out this week, including the November labor report and personal consumption data, as well as speeches from Fed Chair Jerome Powell and other central bank leaders.

Continue reading for more on today's market, including:

The Dow Jones Industrial Average (DJI - 33,849.46) lost 497.6 points, or 1.5% for the day. Merck (MRK) paced the gainers with a 0.9% win. Boeing (BA) led the laggards with a 3.7% loss.

The S&P 500 Index (SPX - 3,963.94) lost 62.2 points, or 1.5% for the day, while the Nasdaq Composite Index (IXIC - 11,049.50) shed 176.9 points, or 1.6%.

Lastly, the Cboe Volatility Index (VIX - 22.2) added 1.7 point, or 8.3% for the session.

5 Things to Know Today

- BlockFi, an embattled crypto firm, has filed for Chapter 11 bankruptcy amid the FTX fallout. (CNBC)

- The Internal Revenue Service (IRS) is warning tax filers that they will need to report transactions that cross the $600 threshold made through so-called "third-party" facilitators like Venmo. (MarketWatch)

- Apple stock is also hurting amid unrest in China.

- This blue-chip giant is flashing a historical bull signal.

- One China-based stock that brushed off today's selloff.

There were no earnings of note today.

Oil Ekes Out Win After Hitting 2022 Lows

Oil prices settled off their lowest level in 2022, as investors brushed off tensions in China and declining demand concerns. The front-month, January-dated crude added 96 cents, or 1.3%, to trade at $77.24 per barrel after earlier slipping back below the $75 mark.

The unrest in China also made gold prices volatile, and the precious metal wound up settling lower. December-dated gold shed $13.70 or roughly 0.8%, to settle at $1,740.30 an ounce.