The Dow settled with a 45-point loss

After waffling at the breakeven during the back half of Monday's session, the Dow eventually settled with a 45-point loss. The S&P 500 and Nasdaq, meanwhile, remained firmly in the red, with the latter logging a triple-digit drop as energy and oil stocks plummeted. The possibility of newly ramped up Covid-19 restrictions in China, following the country's first Covid-related death in six months, pressured sentiment lower, while the Fed's next move is still very much in focus. A bright spot was Walt Disney's (DIS) announcement that former CEO Bob Iger would return to the role.

Continue reading for more on today's market, including:

- Breaking down today's massive put sale on Papa John's.

- What options activity can tell us about Tesla stock.

- Plus, TEVA tumbles; CVNA announces layoffs; and options bears target TSN.

The Dow Jones Industrial Average (DJI - 33,700.28) lost 45.4 points, or 0.1% for the day. Walt Disney (DIS) paced the gainers with a 6.3% win. Intel (INTC) led the laggards with a 3.1% loss.

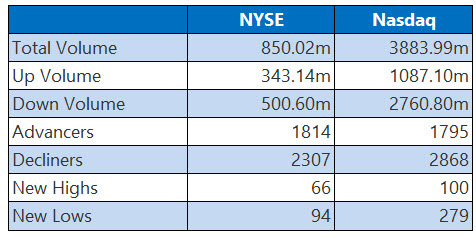

The S&P 500 Index (SPX - 3,949.94) shed 15.4 points, or 0.4% for the day, while the Nasdaq Composite Index (IXIC - 11,024.51) fell 121.6 points, or 1.1%.

Lastly, the Cboe Volatility Index (VIX - 22.36) shed 0.8 point, or 3.3% for the session.

5 Things to Know Today

- Asset manager Grayscale, which also controls the world's biggest bitcoin fund, said it would not share proof of reserves with its customers due to 'security concerns.' (CNBC)

- Fighting near Ukraine's Zaporizhzhia nuclear plant -- Europe's largest atomic power plant -- almost ended in disaster this weekend, as shells fell near reactors and damaged a radioactive waste storage building. (Bloomberg)

- Here's what put pressure on shares of Teva Pharmaceutical today.

- Carvana continues to struggle after Friday's layoff announcement.

- Why options bears are targeting Tyson Foods stock.

Due to technical difficulties the Unusual Options Volume chart is unavailable today

Oil Hits 10-Month Low

The possibility of more lockdowns, compounded by news that the Organization of the Petroleum Exporting Countries (OPEC), including Saudi Arabia, could be planning to raise output by 500,000 barrels per day, sent oil prices spiraling midday. December-dated crude earlier fell to a 10-month low, but end up settling the day with a more muted 35 cent, or 0.4%, loss to trade at $79.73 per barrel.

News of the worsening Covid-19 situation in China, as well as strength for the U.S. dollar, sank gold prices on Monday. December-dated gold lost $14.80 or roughly 0.8%, to settle at $1,739.60 an ounce.