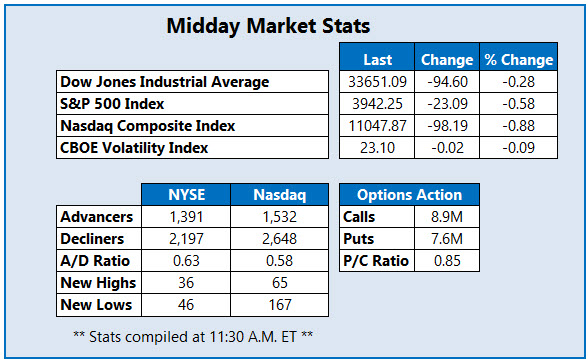

All three benchmarks are firmly lower midday

The Dow Jones Industrial Average (DJI) and Nasdaq Composite (IXIC) are both down over 90 points midday, while the S&P 500 Index (SPX) sits comfortably below fair value as well. Energy and oil stocks are weighing on the market, after the Wall Street Journal reported that the Organization of the Petroleum Exporting Countries (OPEC+), including Saudi Arabia, are considering raising output of 500,000 barrels per day. West Texas Intermediate (WTI) crude hit its lowest level since Jan. 3 after the news, last seen down 5.7% at $75.48 per barrel.

Continue reading for more on today's market, including:

- Bob Iger's homecoming has Disney stock surging.

- Carvana stock continuing to collapse on the charts.

- Plus, options bulls blast penny stock; IMGO soars on buyout; and HP slips lower.

Meta Materials Inc (NASDAQ:MMAT) is seeing a bullish options surge today, with 129,000 calls across the tape so far, which is 14 times the intraday average. The weekly 11/25 2.00-strike call is the most popular, with new positions being bought to open there. MMAT is up 26.2% at $2.09 at last glance, though still down 15.1% year-to-date.

Imago BioSciences Inc (NASDAQ:IMGO) stock is soaring, up 104.3% to trade at $35.53 at last glance and earlier hitting a record high of $35.75, after news that Merck (MRK) is acquiring the company in a cash deal worth $1.35 billion. Year-over-year, the equity is now up 49.5%.

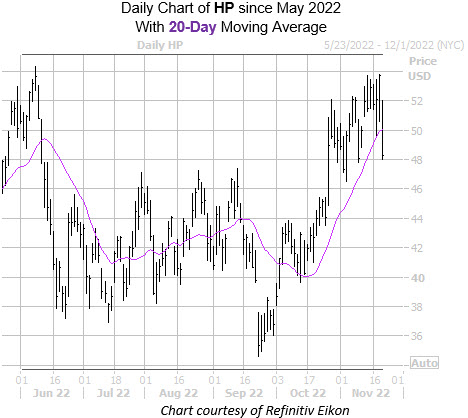

Helmerich & Payne Inc (NYSE:HP) is one of the oil stocks taking a hit today. The security is down 9.2% at $48.78 at last glance, after Friday's 3.2% post-earnings pop. This negative price action has the shares dipping below previous support at their 20-day moving average. Year-to-date, the equity is still up 106.7%.