The S&P 500 logged more modest gains

Better-than-expected jobless data boosted cyclical stocks on Thursday, as optimism over a swift economic recovery grew. The Dow rose more than 141 points, thanks to outsized gains from Boeing (BA). The S&P 500 logged a more modest win, while the Nasdaq settled just below breakeven as traders favored reopening plays over tech, indicating overall market gains may be capped.

Over in Washington, D.C., Senate Republicans countered U.S. President Joe Biden's infrastructure plan with a $928 billion offer. They rejected the idea of raising corporate taxes, too, and suggested employing transportation user fees and Congress-allocated funds. Meanwhile, Treasury Secretary Janet Yellen told congressional leaders to spend more aggressively, noting government spending has not kept up with inflation over the past decade.

Continue reading for more on today's market, including:

- The lowdown on Walmart's newest partnership.

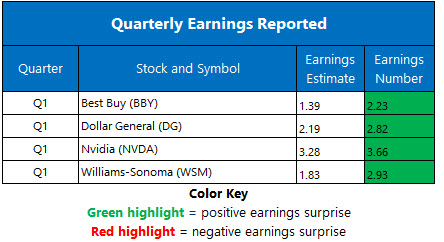

- Why NVDA's crypto update overshadowed an upbeat earnings report.

- Plus, options bulls blast DG; analysts chime in on WSM's earnings beat; and SJM eyes fifth-straight quarterly win.

The Dow Jones Average (DJI - 34,464.64) added 141.6 points, or 0.4% for the day. Boeing (BA) led the Dow components with a 3.9% rise, while Procter & Gamble (PG) paced the laggards, falling 2.3%.

Meanwhile, the S&P 500 Index (SPX - 4,200.88) rose 4.9 points, or 0.1% for the day. The Nasdaq Composite (IXIC - 13,736.28) fell 1.7 points, or 0.01% for the day.

Lastly, the Cboe Volatility Index (VIX - 16.74) lost 0.6 point, or 3.6% for the day.

- WallStreetBets darling AMC Entertainment (AMC) shot up 43%, following bouts of speculative trading activity among Reddit users. (CNBC)

- The Earth has a 40% chance of pushing past the temperature limit on the Paris climate agreement within the next give years, meteorologists say. (MarketWatch)

- Options traders blasted this discount retailer after its earnings bested analysts' estimates.

- Breaking down the sentiment surrounding Williams-Sonoma stock after its Q1 report.

- J. M. Smucker stock is setting its sights on a fifth-straight earnings beat.

Oil Prices Notch Longest Winning Streak Since February

Oil prices scored their fifth-consecutive win on Thursday -- marking the commodity's longest winning streak since February -- as the positive effects from yesterday's drop in weekly U.S. crude and gasoline supplies lingered. However, fears that Iran's crude may soon return to the market kept those gains in check, amid ongoing nuclear deal negotiations. In response, July-dated crude added 64 cents, or 0.1%, to settle at $66.85 per barrel -- its highest close since 2018.

Gold prices were lower, on the other hand, snapping a three-day winning streak, and settling back below the significant $1,9000 level. The yellow metal took a hit as the U.S. dollar hardened, and U.S. Treasury yields surged higher. For the day, August-dated gold fell $5.30, or 0.3%, to settle at $1,898.50 an ounce.