SJM could also potentially be a solid dividend play

The shares of J. M. Smucker Co (NYSE:SJM) are down 1.2% to trade at $132.87 at last check, after Morgan Stanley maintained its "underweight" rating on the security ahead of its fourth-quarter earnings report, which is due out before the open on Thursday, June 3. The analyst in question noted input cost inflation, as well as mixed performance across categories such as food and coffee. Below, we will further analyze how the equity has performed on the charts, and dive into some of its previous post-earnings moves.

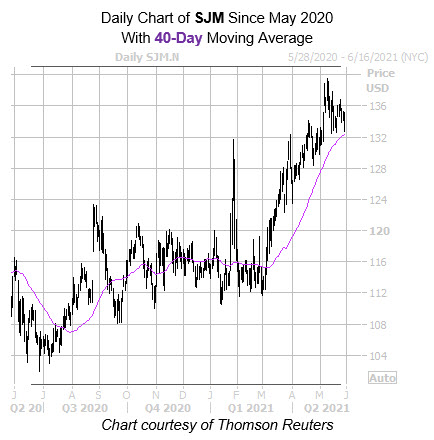

Digging deeper, J. M. Smucker stock is fresh off a May 10, four-year high of $139.54. The 40-day moving average has been a constant source of support for the equity since early March, when shares first pivoted higher. Now, SJM is struggling with overhead pressure at the $137 level, though year-over-year it still sports a 20.8% lead.

Over the past two years, the equity has had a mostly positive history of post-earnings reactions. Looking at its last eight reports, five of these next-day sessions were higher, including a 6.9% pop in August. Additionally, the stock averaged a post-earnings swing of 3.8% the last eight quarters, regardless of direction. This time, the options market is pricing in a similar move of 3.5%.

Though the stock presents some fundamental issues, it remains a great potential dividend play. In the long term, the company has maintained decent revenue growth, which can be attributed its ability to capture a good portion of the available market share. Moreover, SJM's trailing 12-month revenue is up 4.8% since 2020, and has increased by 11% since 2018.

The company's biggest issues right now are its balance sheet and 2019 net income. Unfortunately, SJM carries a debt load of $5 billion, with only $501.5 million in cash. In addition, J. M. Smucker saw a 62% decline in net income for 2018, though over the past 12 months it has increased net income by 22.6%.

Overall, the security presents a solid valuation, at a price-earnings ratio of 15.83. Plus, SJM can produce decent returns from dividends for investors looking for a safer long-term investment.