Both the Dow and Nasdaq logged triple-digit losses

The market decline worsened by the end of Wednesday's session as Big Tech's extended selloff and a higher-than-expected jump in inflation data continued to take a toll on Wall Street. April inflation grew at its fastest rate since 2008, leaving investors worried it could start to negatively impact margins and corporate profits.

The Dow fell 681 points, settling at its lowest close in over a month, and marking its biggest drop since Jan. 29. The Nasdaq and S&P 500 also closed with substantial losses, with the latter logging its worst day in over two months. Meanwhile, the Cboe Volatility Index (VIX) -- Wall Street's fear gauge -- closed above the 27 mark for the first time since its March 4 spike.

Continue reading for more on today's market, including:

- This streaming name surged after hiking its full-year forecast.

- Wendy's stock locked in a fresh high for 2021 after an upbeat earnings report.

- Plus, why EA turned volatile; INTU's pre-earnings bull note; and one oil stock with plenty of room to run.

The Dow Jones Industrial Average (DJI - 33,587.66) shed 681.5 points, or 2% for the day. Merck & Co (MRK) led the Dow components with a 0.7% rise, while Home Depot (HD) paced the laggards, falling 4.1%.

Meanwhile, the S&P 500 Index (SPX - 4,063.04) fell 89.1 points, or 2.1% for the day. The Nasdaq Composite (IXIC - 13,031.68) shaved 357.8 points, or 2.7% for the day.

Lastly, the Cboe Volatility Index (VIX - 27.59) added 5.8 points, or 26.3% for the day.

- The pace of Covid-19 vaccinations in the U.S. is improving, with an average of 2.2 million shots a day and an increase in first doses, after being on decline for several weeks. (CNBC)

- GasBuddy, an app that helps users find gas stations with the cheapest prices, hit the no. 1 spot on Apple's (AAPL) store after gas prices topped $3 for the first time in over six years. (MarketWatch)

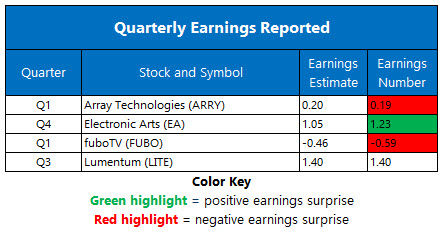

- Option traders blasted this gaming name following some post-earnings volatility.

- Intuit stock scored a fresh bull note ahead of this month's quarterly report.

- Bullish signal says red-hot Antero Resources stock has more room to run.

Gold Drops as U.S. Treasury Yields, Dollar Surge

Oil prices hit their highest peak since March on Wednesday, after the International Energy Agency (IEA) kept its outlook for the second half of 2021 steady, noting it expects global demand for oil to be closer to pre-pandemic levels by later this year. Plus, fresh data showed a drop in U.S. crude inventories, as gasoline shortages continued to impact the southeast U.S. after the Colonial Pipeline cyberattack. In turn, June-dated crude added 80 cents, or 1.2%, to settle at $66.08 per barrel.

Meanwhile, gold prices logged their second consecutive loss for the first time this month. A rise in U.S. Treasury yields and a stronger dollar contributed today's drop. As a result, June-dated gold fell $13.30, or 0.7%, to settle at $1,822.80 an ounce.