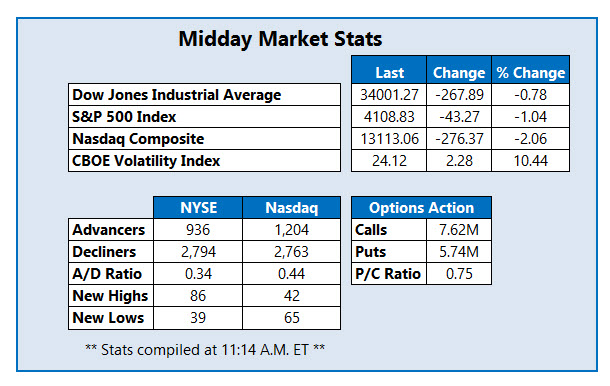

The Dow is off over 267 points midday

Even more pressure is being applied to stocks today, with the Dow Jones Industrial Average (DJI) last seen down over 267 points midday. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are feeling the heat, too, as the former drops back below Tuesday's bottom -- a level investors have been keeping an eye on.

Big Tech's prolonged selloff is combining with a surprising pop in inflation data, and it's crippling Wall Street. April's Consumer Price Index (CPI) rose 4.2%, marking the number's speediest leap since 2008. This massive market selloff is stoking Wall Street's "fear gauge" -- the Cboe Volatility Index (VIX). The index set for its first close above the 24 mark since March 9.

Continue reading for more on today's market, including:

- Intuit stock is bucking the broad market selloff, so far.

- The gaming stock blitzed by options traders.

- Plus, option bulls play the OXY bounce; penny stock breaks out; and record lows for ARRY.

One stock seeing an uptick in option activity today is Occidental Petroleum Corporation (NYSE:OXY). The stock is surging, up 6.4% at $26.10 at last check, attempting to erase Tuesday's negative post-earnings 7.9% bear gap even after its first-quarter results topped forecasts. The 100-day moving average caught most of yesterday's dip, though OXY is still well below its pre-earnings close. At last check, 40,000 calls and 4,443 puts have been exchanged so far today -- four times the intraday average. The May 30 call is the most popular, followed closely by the weekly 5/14 26-strike call.

One of the better performers on the New York Stock Exchange (NYSE) today is RA Medical Systems Inc (NYSE:RMED). The medical device company reported losses of $2.48 per share and said it enrolled 20 subjects in its atherectomy pivotal clinical study since mic-March, bringing its total enrolled subjects to 50. At last check, RMED was up 76.7% to trade at $5.82, toppling pressure at its 30-day moving average and pacing for its highest close since March.

An earnings report is moving Array Technologies Inc (NASDAQ:ARRY), too, though Wall Street has not had such a favorable reaction. The security is one of the worst Nasdaq performers today, off 34.2% at $16.41 at last check, after the company's first-quarter profits missed analysts estimates. Array Technologies also warned that a continual increase in supply costs could negatively impact its current-quarter margins. The word of caution elicited several bear notes from analysts, including Simmons Energy, which slashed its rating to "neutral" from "overweight," and cut its price target to $27 from $53. The security is trading at its lowest level on record, and is now off 61.6% for the year.