The Nasdaq logged a weekly loss, however

The major indexes wrapped up the day with gains, but not without some initial volatility, which plagued markets for most of the week. The Dow added over 229 points to log its third-straight record closing high, after a brief dip into the red earlier in the day. The S&P 500 and Nasdaq also logged notable daily wins, though only the Dow and S&P 500 nabbed weekly gains.

Much of today's activity was brought on by a weaker-than-expected April jobs report, though by the end of the session investors began to interpret it as an indicator that the Federal Reserve could maintain its lenient economic policy. However, the report also stoked fears of whether a full economic recovery could happen as quickly as some had anticipated.

Continue reading for more on today's market, including:

- Movie theater name pops despite earnings miss.

- Bear notes galore for Peloton stock on slashed profit forecast.

- Plus, why copper's run is here to stay; ROKU earnings top analysts' estimates; and 9 cannabis stocks making moves.

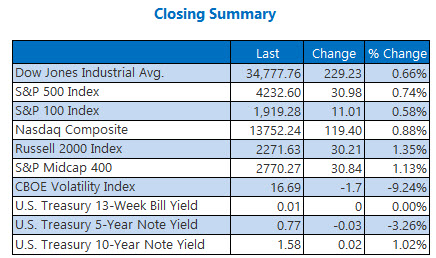

The Dow Jones Industrial Average (DJI - 34,777.76) rose 229.2 points, or 0.7% for the day, and 2.7% for the week. Nike (NKE) led the Dow components with a 3.2% rise, while Verizon Communications (VZ) paced the laggards, falling 1%.

Meanwhile, the S&P 500 Index (SPX - 4,232.60) added 31 points, or 0.7% for the day, and 1.2% for the week. The Nasdaq Composite (IXIC - 13,752.24) jumped 119.4 points, or 0.9% for the day, but lost 1.5% for the week.

Lastly, the Cboe Volatility Index (VIX - 16.69) fell 1.7 point, or 9.2% for the day, and 10.3% for the week.

- The U.K. revealed a list of 12 countries that England residents will be able to visit without quarantining upon their return, which includes nations such as Portugal and New Zealand. (CNBC)

- India logged a record of over 414,000 new Covid-19 infections in a single day, as Prime Minister Narendra Modi comes under pressure to implement a nationwide lockdown. (MarketWatch)

- Schaeffer's Founder and CEO Bernie Schaeffer analyzes copper's run.

- Roku stock bounces back on upbeat earnings and revenue.

- These marijuana stocks lit up during the first week of May.

Gold, Oil Prices End Week on High Note

Oil prices turned higher on Friday, thanks to upbeat sentiment surrounding easing travel restrictions in the United States and Europe, as well as prospects of economic recovery. Weakness in the U.S. dollar also helped prices, though investors are still worried about rising Covid-19 cases in India. In response, June-dated crude added 19 cents, or 0.3%, to settle $64.90 per barrel for the day. For the week, it rose 2.1%.

Gold prices were also higher, managing to register a roughly three-month high after the dismal April jobs report showed U.S. nonfarm payrolls missed analysts' estimates by a long short. This reinforced the idea the Federal Reserve may keep interest rates low, which boosted the metal. June-dated gold jumped $15.60, or 0.9%, to settle at $1,831.30 an ounce. It was 3.6% higher for the week.