Per our data, Nucor stock enjoyed an average one-month return of 12.1%

On Wednesday, U.S. President Joe Biden's sweeping $2.3 trillion infrastructure bill received 58% approval from Americans in a new CBS news poll. If there's one area of American life that can draw on bipartisan support, its infrastructure; the poll went on to show at least 3 of 4 approve of spending additional federal money on five areas of investment, when asked generally without Biden's name or either party attached. This includes roads and bridges, water pipes, elderly home care, broadband internet in rural areas, and building public schools.

All of this is a long-winded way of saying the infrastructure bill has a chance of making its way through Washington D.C. expediently, or at the very least a compromised version. As polls like these trickled in, copper toppled $10,000 on Thursday and iron ore prices – an integral component to steel – hit a record high. The question then becomes, is there still room for these commodities to run? At the very least, we're going to highlight some stocks that could benefit from this commodity super cycle.

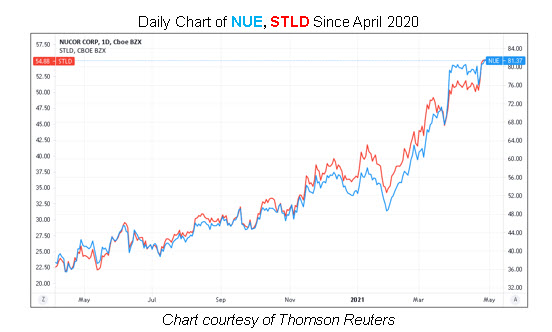

Nucor (NUE) and Steel Dynamics (STLD) both flashed bullish signals on the charts recently. NUE and STLD are both fresh off a round of record highs. According to a study from Schaeffer's Senior Quantitative Analyst Rocky White, these recent highs come amid historically low implied volatility (IV) -- a bullish combination for both stocks in the past.

White's study shows that for both stocks, there have been two other times in the past five years when the securities were trading within 2% of its 52-week high, while their Schaeffer's Volatility Index (SVI) stood in the 20th percentile of their annual range or lower, as is the case with NUE's SVI of 31%, which sits in just the fourth percentile of its 12-month range, and STLD's SVI of 35%, which sits in the bottom percentile of its 12-month range.

According to this data, Nucor stock enjoyed an average one-month return of 12.1% following these signals and was higher both times. For Steel Dynamics, the stock averaged a one-month return of 9.1% and also held a 100% positivity rate. For both NUE and STLD, moves of similar magnitude would put both stocks at new record levels.

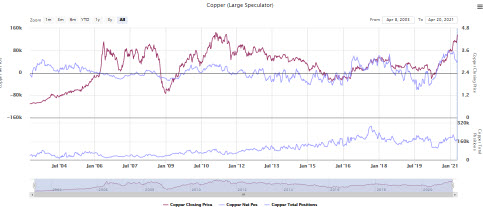

Biden's bill may also mean copper – which is up nearly 300% year-over-year as of Wednesday – could receive some of those legislative tailwinds. Large amounts of copper are required to rebuild modern infrastructure and energy systems. Per a chart curated by Schaeffer's Senior Market Strategist Chris Prybal on Wednesday, large speculators of copper are starting to cool off, even as the metal advances. What that means is this latest copper rally is not supported by fresh buying, which underscores its technical tenacity.

Subscribers to Bernie Schaeffer's Chart of the Week received this commentary on Sunday, May 2.