Big Tech is recovering from yesterday's selloff

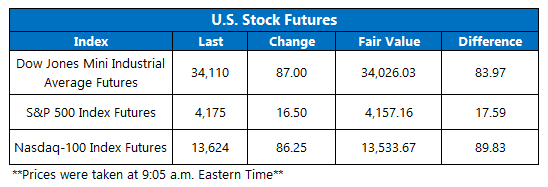

Stock futures made a comeback today, rebounding after a session plagued by a Big-Tech selloff. Outside of strong earnings from the sector, shares of Apple (AAPL) and Tesla (TSLA) are rising ahead of the bell, after yesterday falling 3.5% and 1.7%, respectively. At last check, futures on the Dow Jones Industrial Average (DJI) are eyeing a more than 80-point open, while S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) futures are noticeably higher as well. Lastly, according to ADP, private payrolls rose by 742,000 in April, a lofty move that was still below the 800,000 jobs economists expected to be added.

Continue reading for more on today's market, including:

- Schaeffer's Senior Quantitative Analyst Rocky White shows how to use copper to indicate market strength.

- iRobot stock plummeted despite a stellar Q1.

- Plus, more on ATVI's post-earnings pop; bear notes roll out for Zillow stock; and Office Depot's parent company makes big announcement.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.4 million call contracts traded on Tuesday, and 841,688 put contracts. The single-session equity put/call ratio rose to 0.58 and the 21-day moving average stayed at 0.47.

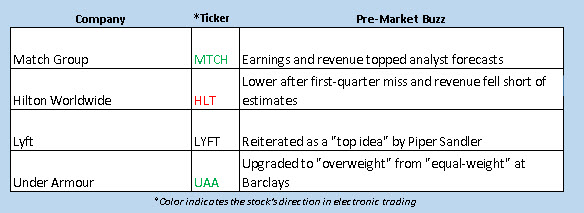

- Activision Blizzard, Inc. (NASDAQ:ATVI) is up 5.5% before the bell, after the video game company yesterday announced earnings and revenue that came in well above Wall Street's forecasts. In addition, Activision Blizzard upped its full-year guidance, citing elevated demand for its "Call of Duty" and "Candy Crush" titles. Today's positive price action could help ATVI reclaim its 2021 breakeven level, which it sits 4.5% below.

- Real estate website Zillow Group Inc (NASDAQ:ZG) is up 2.4% ahead of the open, after reporting first-quarter earnings of 44 cents per share on revenue of $1.22 billion -- both well above analysts forecasts. Still, no less than eight brokerages have chimed in with price-target cuts, including a drop to $155 from $210 at Craig-Hallum. Year-to-date, Zillow stock is off 8.9%.

- The shares of Office Depot parent ODP Corp (NASDAQ:ODP) are up 4.7% in electronic trading. ODP announced it would split into two separate publicly traded companies, with the new company containing ODP's business-to-business operations. It was also reported that shareholder will own 100% of the still unnamed new company. The company also reported better-than-expected first-quarter earnings. ODP has tacked on nearly 45% in 2021.

-

Much of the attention today will be on the ADP employment report., alongside the Markit services PMI, as well as the ISM services index.

European Stocks Higher on Blowout Earnings

Hong Kong’s Hang Seng fell 0.5% on Wednesday, after the Big Tech selloff and U.S. Treasury Secretary Janet Yellen’s cautionary interest rate comments led to stateside losses. Elsewhere, China’s Shanghai Composite, Japan’s Nikkei, and South Korea’s Kospi were observing holidays.

Meanwhile, European markets are on the upswing, thanks to encouraging economic data and corporate earnings reports. For one, delivery concern Deutsche Post, also known as DHL, blew past analysts’ estimates and boosted its financial guidance. Plus, the IHS Markit’s final purchasing managers’ index (PMI) showed euro zone business activity picked up in April. In response, the German DAX was last seen up 1.5%, London’s FTSE 100 is up 1.2%, and France’s CAC 40 has added roughly 1%.