Activision Blizzard will report first-quarter earnings after today's close

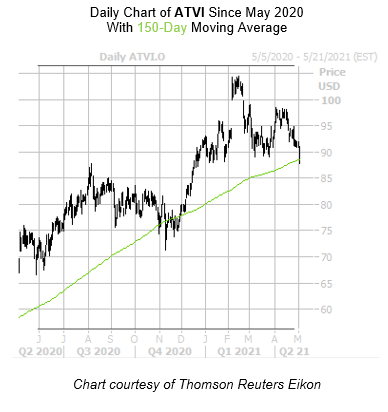

The shares of Activision Blizzard Inc (NASDAQ:ATVI) are cooling off today, last seen down 3.4% to trade at $88.09. The security is poised to close blow the $89 level for the first time since late January, and are contending with long-term support at its 150-day moving average today. Now down 4.6% in 2021, today's negative price action comes just ahead of the company's first-quarter earnings report, due out after the close today. Below, we'll dig deeper on Activision Blizzard stock's technical setup, and why things may get a bit worse for the equity before they get better.

Analysts are quite bullish on ATVI. Of the 19 brokerages covering the stock, 16 sport a "buy" or better rating, with no "sells" on the books. Plus, the 12-month consensus price target of $113.29 is a hefty 28.4% premium to current levels, leaving ample room for a round of post-earnings price-target cuts if needed.

The options pits have started to tilt toward puts. The stock's 10-day put/call volume ratio of 0.87 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands higher than all other readings from the past year. So while calls still outnumber puts on an absolute basis, the high percentile implies a healthier-than-usual appetite for puts of late.

There's a similar activity in today's options pits. So far, 32,000 calls and 24,000 puts have crossed the tape so far -- four times what's typically seen. Most popular are the June 100 and 95-strike calls, with positions being opened at the latter.

A look back at the video game company's earnings history reveals that only three of the past eight sessions had a positive post-earnings response. The security averaged a next-day return of 3.9%, regardless of direction. This time around, the options market is pricing in a much bigger move of 8.1%.