Declining bond yields likely pared further losses

The Dow closed 97 points lower today, brushing off second day of upbeat economic data, this time in the way of strong jobs data for February. The S&P 500 and Nasdaq hovered around breakeven most of the day, though both closed at modest losses and snapped three-day winning streaks. Declining bond yields likely pared further losses, while investors kept an eye on any updates regarding U.S. President Joe Biden’s $2 trillion infrastructure proposal. Covid-19 vaccine news gave sentiment a boost as well, after word that Biden is expected to move the eligibility deadline for all Americans to April 19 from the previous May 1, given the higher supply.

Continue reading for more on today's market, including:

- Severe winter storms weigh on this energy giant.

- Analysts chime in on Illumina stock after upbeat guidance.

- Plus, the technicals behind this fitness name; Social media stock on the mend; and CARA enjoys best day in over a year.

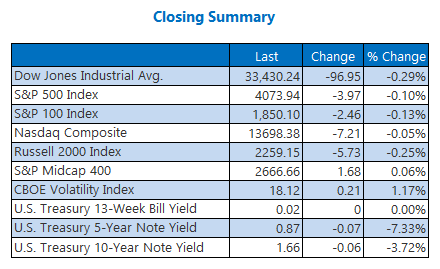

The Dow Jones Industrial Average (DJI - 33,430.24) lost 97 points today, or 0.3%. Nike (NKE) topped the list of blue chips with a 1.5% pop, while Walgreen Boots Alliance (WBA) sunk to the bottom after shedding 1.9%.

Meanwhile, the S&P 500 Index (SPX - 4,073.94) dipped 4 points, or 0.1%, and the Nasdaq Composite (IXIC - 13,698.38) lost 7.2 points, or 0.1% for the day.

Lastly, the Cboe Volatility Index (VIX - 18.12) added 0.2 point, or 1.2%, today.

- Federal vaccine passports have been considered to verify Covid-19 immunization status. The Biden administration today made a decision on that and the proposed vaccinations database. (Marketwatch)

- California plans to lift most pandemic restrictions by this date. The state will also end its color-coded tier system, which has been used to determine risk levels. (CNBC)

- A look at TVTY's growth over the past year.

- Snap stock extends rebound after analyst praise.

- A short squeeze could push CARA even higher.

Oil, Gold Rise on Upbeat Economic Data

Oil prices rose today, after economic data from China suggested stronger-than-expected energy demand and talks of reintroducing the Iran nuclear deal surfaced. May-dated crude gained 68 cents, or 1.2%, to settle at $59.33 per barrel.

Gold prices rose for the fourth-straight session, after the International Monetary Fund (IMF) raised its global economic growth outlook. Declining bond yields also pushed prices higher, and June-dated gold added $14.20, or 0.8%, to settle at $1,743 an ounce -- their highest finish since late February.